WikiFX Spring Festival Message | Grounded in Transparency, Walking with Trust

As the Lunar New Year approaches, renewal is in the air. It is a moment to bid farewell to the old, welcome the new, and reflect while moving forward.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

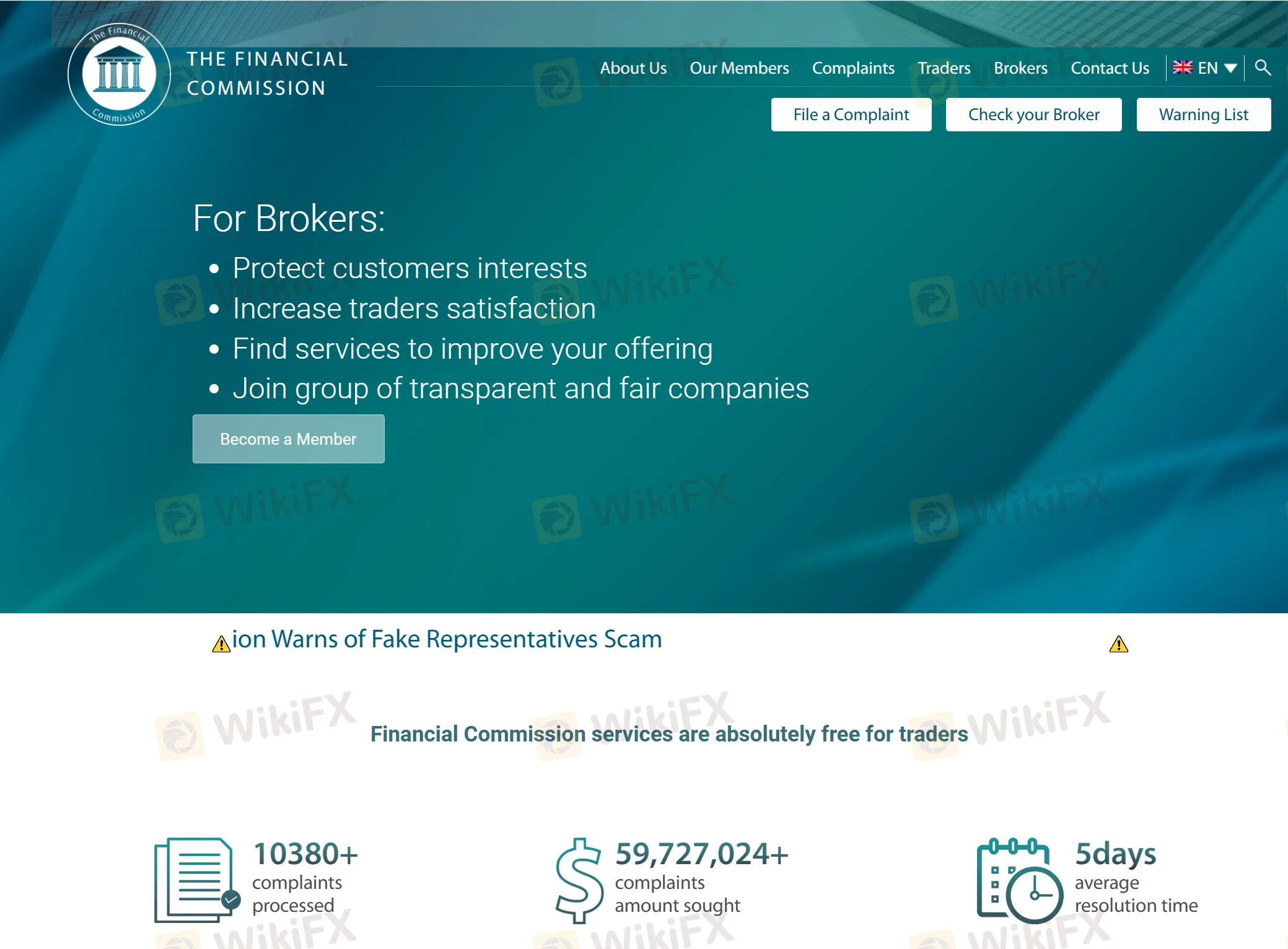

Abstract:With the rise of online trading platforms, the need for robust oversight has never been more critical. Enter "The Financial Commission," a company that has garnered attention for its mission to expose scam brokers. However, a closer examination reveals complexities and considerations that investors should be aware of before placing blind trust in its pronouncements.

With the rise of online trading platforms, the need for robust oversight has never been more critical. Enter “The Financial Commission,” a company that has garnered attention for its mission to expose scam brokers. However, a closer examination reveals complexities and considerations that investors should be aware of before placing blind trust in its pronouncements.

Founded with the goal of safeguarding investors from fraudulent practices, The Financial Commission operates independently of governmental regulatory bodies. While its intentions may be commendable, it's essential to recognize the limitations inherent in its role. Unlike official regulators empowered by legislation, The Financial Commission lacks the authority to enforce compliance or impose sanctions on errant brokers.

Central to understanding The Financial Commission's efficacy is its methodology for identifying and exposing scam brokers. The company employs its own set of criteria, which may not necessarily align with industry standards or represent a consensus within the market. Consequently, there is a degree of subjectivity involved in its assessments, raising questions about the objectivity and reliability of its revelations.

Moreover, it's crucial for investors to exercise discernment when interpreting the findings published by The Financial Commission. While the company endeavors to provide valuable insights, its determinations may not carry the same weight as those made by established regulatory bodies. Investors should view its revelations as one of many sources of information and not as a definitive verdict on a broker's legitimacy.

In navigating the complexities of the financial industry, regulatory exposure in the private sector can offer guidance but should not be solely relied upon. Investors must conduct thorough due diligence, drawing upon a variety of reputable sources, including governmental regulators, industry experts, and independent reviews.

Ultimately, while The Financial Commission plays a role in exposing scam brokers, it's essential for investors to maintain a critical perspective. While its efforts are commendable, they should be viewed as complementary rather than a substitute for official oversight. In the quest for a trustworthy trading experience, prudence and vigilance remain investors' most potent allies.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

As the Lunar New Year approaches, renewal is in the air. It is a moment to bid farewell to the old, welcome the new, and reflect while moving forward.

XSpot Wealth has found many negative comments from traders who have allegedly been deceived by the broker. Traders constantly accuse the broker of causing unnecessary withdrawal blocks and forcing them to continue depositing with it. Many user complaints emerged on WikiFX, a leading global forex regulation inquiry app. In this XSpot Wealth review article, we have investigated multiple complaints against the broker. Read on!

Did SEVEN STAR FX make unreasonable verification requests and block your forex trading account later? Did the broker prevent you from accessing fund withdrawals? Were you made to wait for a long time to receive a response from the broker’s customer support official? Have you had to seek legal assistance to recover your stuck funds? Well, these are some claims made by SEVEN STAR FX’s traders. In this SEVEN STAR FX review article, we have looked closely at the company’s operation, the list of complaints, and a take on its regulatory status. Keep reading to know the same.

When traders search for "Is ZarVista Safe or Scam," they want to know if their capital will be safe. Nice features and bonuses do not matter much if you can't trust the broker. This article skips the marketing talk and looks at real evidence about ZarVista's reputation. We want to examine actual user reviews, look into the many ZarVista Complaints, and check the broker's legal status to get a clear picture. The evidence we found shows serious warning signs and a pattern of major user problems, especially about the safety and access to funds. This report gives you the information you need to make a smart decision about this risky broker.