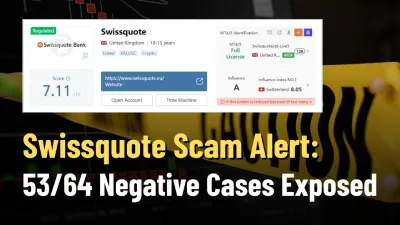

Swissquote Scam Alert: 53/64 Negative Cases Exposed

Swissquote has 53/64 negative cases on WikiFX despite regulation (FINMA/FCA). Reports cite deposit delays & withdrawals. Avoid scams, read exposure now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Webull Canada launches a desktop trading platform with advanced tools for more informed decisions. The platform offers customizable features for all levels of traders.

Webull Canada has launched its desktop platform, a long-awaited innovation designed to improve trading efficiency. In addition to the mobile app, which debuted earlier this year to rave acclaim, the launch represents a significant expansion of Webull's services in Canada.

CEO Michael Constantino of Webull Securities (Canada) Limited emphasized the significance of the desktop platform for the organization's growth. “Webull Desktop Platform was a logical next step after our mobile app launch in January,” Constantino stated, emphasizing that the desktop version was created in response to user demand and meant to work in unison with the mobile experience to offer a full trading environment.

One of the most notable features of the desktop platform is the ability for users to utilize customizable multi-screens. This feature allows traders to rearrange widgets and modify their screens to better evaluate market patterns and access data in a manner that suits their trading style, resulting in more informed decision-making processes. The desktop platform has several features to suit both rookie and professional traders.

This level of customization and advanced analytics was previously only available on the mobile app, but with the desktop version, Webull is set to provide a more robust and flexible trading experience. Moreover, with support for over sixty indicators and more than twenty charting elements, the platform provides users with sophisticated instruments to precisely interpret market conditions.

Webull continues to demonstrate its commitment to enhancing the user experience by introducing a cash management solution that provides appealing interest rates on unsold cash (4% in Canadian dollars or 3% in U.S. dollars). This initiative aims to provide Webull Canada customers with the opportunity to generate passive income in the face of market volatility, with no account minimums or suspension periods.

The choice to launch a desktop platform aligns with the current aggressive development strategy of Webull Canada within the financial services industry. Since resuming operations in January of this year, following authorization in November 2023, the company has made considerable strides in the Canadian market, providing order execution-only brokerage services, extensive market data, and educational resources designed to help users understand the trading process.

Webull is a multinational trading company based in St. Petersburg, Florida, where its headquarters are situated. Its backers consist of private equity investors from the United States, Europe, and Asia. Webull provides access to financial markets around the clock for its millions of consumers in over 180 countries. By introducing the desktop platform to the Canadian market, the organization reinforces its service portfolio and showcases its commitment to delivering innovative and user-friendly trading solutions.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Swissquote has 53/64 negative cases on WikiFX despite regulation (FINMA/FCA). Reports cite deposit delays & withdrawals. Avoid scams, read exposure now!

Money Plant FX is offshore, unregulated, and flagged high risk, with traders alleging zeroed balances. Check the facts before you open an account.

When looking at a forex broker, traders often find confusing and mixed information. This is exactly what happens with ACY Securities. On one side, it's a broker that has been operating for 10-15 years and has a good license from the Australian Securities and Investments Commission (ASIC). On the other hand, there are many serious complaints that show a very different story. As of early 2026, websites, such as WikiFX, have lowered the broker's score because they received over 156 user complaints, with a total of 182 "Exposure" reports filed. This creates a big problem for people who might want to use this broker. The main question this article will answer is: Is ACY SECURITIES legit, or are the many ACY SECURITIES scam claims actually true about how it does business? We will look at facts we can prove, study the broker's rules and regulations, examine the patterns in user complaints, and give a clear, fact-based answer about the risks of working with this broker. Our goal is to cut thr

ACY Securities shows a complicated picture for traders. On one side, it is a well-known broker that has been running for more than ten years and has a license from a top-level regulator. On the other side, it is a company that faces many serious complaints from users and official warnings from several international financial authorities. This ACY SECURITIES Review aims to explain these differences. We will give a fair and thorough analysis of both what the broker advertises and the serious risks that users have reported. At its heart, ACY Securities is a story of attractive trading conditions that are overshadowed by major user complaints and questions about whether it can be trusted. Our goal is to examine the facts, look at the evidence, and help you make a completely informed decision about your capital’s safety.