Abstract:In the dynamic world of Forex trading, where vast fortunes can be made or lost in the blink of an eye, scammers continuously seek ways to exploit regulatory weaknesses, leaving investors vulnerable to fraudulent schemes. The UK and Europe, with their robust financial markets, are unfortunately not immune to these scams. One of the significant challenges faced by regulators is the exploitation of regulatory loopholes by unscrupulous individuals.

In the dynamic world of Forex trading, where vast fortunes can be made or lost in the blink of an eye, scammers continuously seek ways to exploit regulatory weaknesses, leaving investors vulnerable to fraudulent schemes. The UK and Europe, with their robust financial markets, are unfortunately not immune to these scams. One of the significant challenges faced by regulators is the exploitation of regulatory loopholes by unscrupulous individuals.

Forex scammers often operate in the shadows, taking advantage of regulatory gaps to create fraudulent schemes that promise high returns but deliver devastating losses. Despite the diligent efforts of regulatory bodies, the constantly evolving nature of these scams makes it difficult to eradicate them completely.

Navigating Regulatory Challenges: The Role of WikiFX

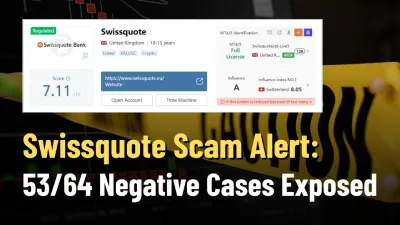

Amidst these challenges, WikiFX emerges as a beacon of support for investors. By meticulously evaluating Forex brokers and monitoring their compliance with regulations, WikiFX provides investors with a reliable platform to assess the legitimacy of trading entities. This comprehensive analysis empowers investors to make informed decisions, ensuring they steer clear of brokers involved in exploitative practices.

Finding WikiFX is as easy as navigating to their official website, www.wikifx.com. Here, investors can access a wealth of information about various brokers, including their regulatory status, trading platforms, and user reviews. Armed with this knowledge, investors are better equipped to identify brokers who operate within the bounds of the law.

How WikiFX Can Help: A Subtle Advertisement

WikiFXs dedication to transparency and investor protection is unparalleled. By offering a user-friendly interface and a vast database of broker information, WikiFX simplifies the process of vetting potential brokers. The platform allows users to search for brokers based on specific criteria, making it effortless to find trustworthy partners for Forex trading endeavors.

Investors can rest easy knowing that WikiFXs team of experts conducts thorough research and verification processes. These efforts ensure that the information provided on the platform is accurate, reliable, and up-to-date. WikiFX not only equips investors with the tools to avoid scams but also educates them about the importance of choosing regulated brokers.

In a landscape where regulatory loopholes can spell disaster for investors, WikiFX stands as a reliable ally. By choosing brokers listed and verified on WikiFX, investors significantly reduce their risks, safeguarding their investments from fraudulent schemes.

In conclusion, as Forex scammers continue to exploit regulatory weaknesses in the UK and Europe, investors must exercise caution and due diligence. Platforms like WikiFX play a vital role in leveling the playing field. By providing transparent, reliable, and updated information about Forex brokers, WikiFX ensures that investors can navigate the complexities of the market with confidence.

To learn more about how WikiFX can assist you in making secure and informed Forex trading decisions, visit their official website at www.wikifx.com. Empower yourself with knowledge, protect your investments, and join the ranks of savvy investors who rely on WikiFX for a safer trading experience.