WikiFX Spring Festival Message | Grounded in Transparency, Walking with Trust

As the Lunar New Year approaches, renewal is in the air. It is a moment to bid farewell to the old, welcome the new, and reflect while moving forward.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:In this article, we'll look in-depth at Ridder Trader Group, examining its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service.

In this article, we'll look in-depth at Ridder Trader Group, examining its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX aims to provide you with the information you need to make an informed decision about using this platform.

Background:

Ridder Trader Group or Ridder Trader LTD (Ridder Trader) is a global online forex and CFD broker that offers over 200 trading instruments, including stocks, forex pairs, global indices, futures, precious metals, and commodities.

The company is a registered company in Malaysia, with registration number 25924 BC 2020. Its registered address and headquarters is at BO1-C-9-1 (Pillar 2), Menara 2, KL Eco City, No.3, Jalan Bangsar, Kg Haji Abdullah Hukum, 59200 Kuala Lumpur.

In addition, Ridder Trader's Personal Multi Account Manager (PMAM) is a tool that can help money managers and professional traders improve their efficiency and profitability and generate passive income via copy-trading.

Moreover, Ridder Traders also offers an introducing broker (IB) program that allows individuals and businesses to earn commissions that will be paid out weekly by referring new clients to the company.

Types of Accounts:

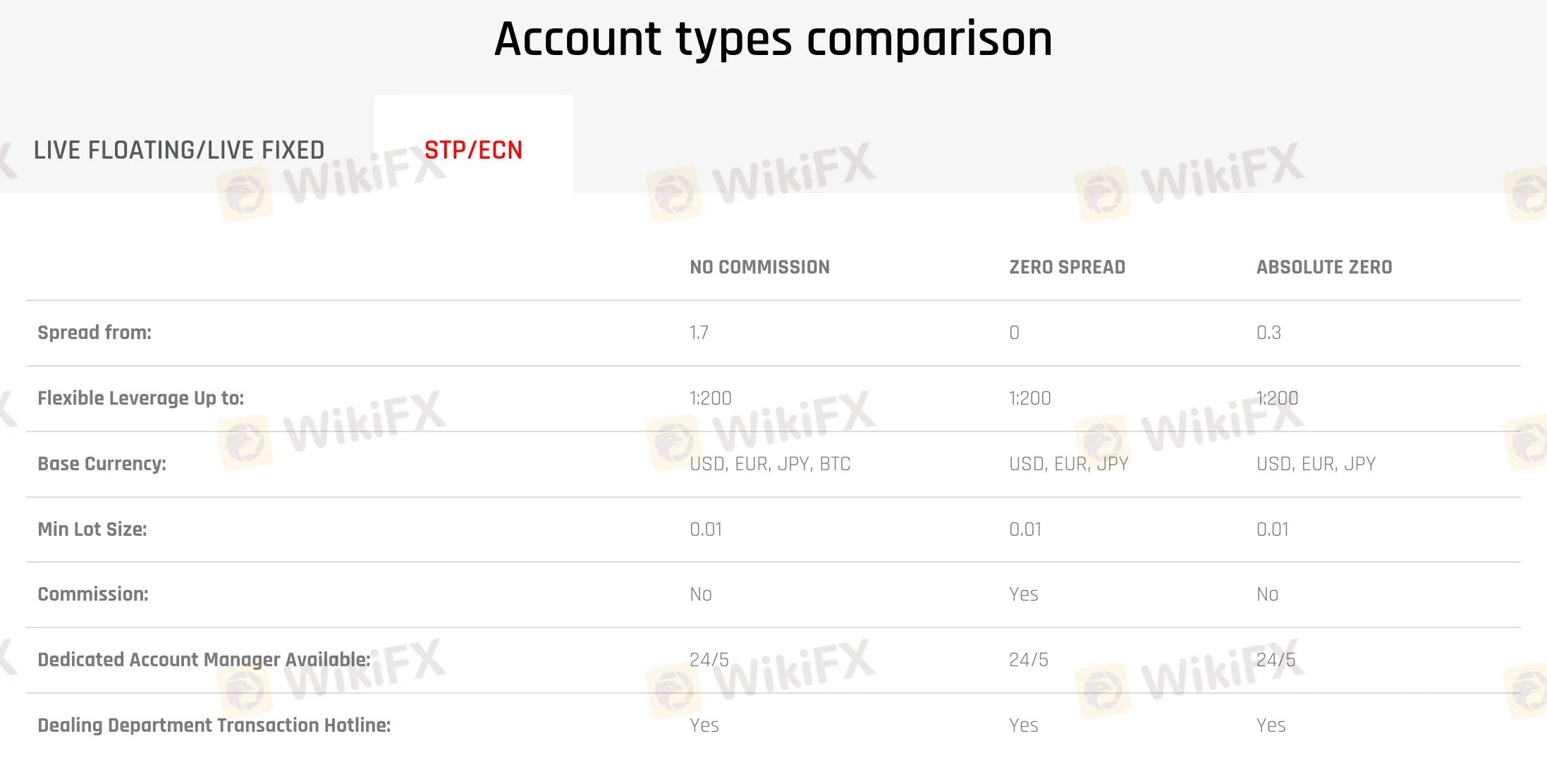

Ridder Trader offers several types of accounts, separated into two main categories: live floating/live fixed and STP/ECN. Each account type has its own unique features, such as different spreads and commissions, but the minimum deposit required for each account is not disclosed.

Within the live floating/live fixed category, there are four different types of accounts: micro, premium, VIP and zero fixed.

The first account option, the Micro Account, is a commission-free account that offers a leverage level of 1000 times with spreads starting from 1.8 pips. Secondly, the Premium account is also a commission-free account that provides a leverage level of 1000 times with spreads starting from 1.6 pips. Thirdly, the VIP account is a commission-free account that offers a leverage level of 1000 times with spreads starting from 1.4 pips. The last account within this category is the zero fixed account that offers spreads starting from 0 pips but incurs variable commission charges. Please refer to the image above for more detailed information.

The second category of accounts offered by Ridder Trader is the STP/ECN category. Within this category, there are three different types of accounts: no-commission account, zero-spread account, and absolute zero account. All these accounts charge a much lower spread than those within the first category but with only a maximum leverage level of 200 times. The first account option, the zero-commission account, involves spreads starting from 1.7 pips. The second account is the zero spread account with spreads starting from 0 pips. Lastly, the absolute zero account offers spreads starting from 0.3 pips.

Deposit and Withdrawals:

Ridder Trader does not provide information about its deposit and withdrawal methods, fees, processing times, or limits. This lack of transparency concerns potential clients, making it difficult to compare Ridder Trader with other brokers or assess the convenience of its services. Additionally, there may be hidden costs or uncertainty regarding transaction processing. To build trust with their clients, brokers should provide detailed information about their deposit and withdrawal methods, fees, processing times, and limits.

Trading Platforms:

Ridder Trader's trading platform is the TradeEvo platform, which resembles the MT5 is a popular multi-asset trading platform that offers a wide range of features, including powerful technical analysis tools, flexible charting tools, advanced order management tools, automated trading, and cross-platform compatibility. Traders and investors can use it to trade forex, CFDs, stocks, and futures. TradeEvo is available for desktop, web, and mobile devices.

Research & Education:

Ridder Trader is at a significant disadvantage when it comes to educational resources. The company does not offer any trading tutorials, webinars, seminars, or educational materials to help traders improve their trading skills. This lack of educational resources is likely to be a major drawback for new traders who are just starting out and need guidance on how to trade effectively.

Customer Service:

As mentioned above, Ridder Trader provides one registered address for clients who want to reach them physically. Alternatively, they can reach out through info@riddertrader.com or at +60 3220 19194. The broker claims to respond to all enquiries within 24 hours during business days. Regrettably, Ridder Trader only provides English and Mandarin customer support service, which is relatively lacking compared to its industry peers.

Conclusion:

To summarize, here's WikiFX's final verdict:

WikiFX, a global forex broker regulatory platform, has given Ridder Trader a WikiScore of 6.53 out of 10, indicating that it is a safe broker within the industry.

WikiFX verified both licenses held by Ridder Trader, as displayed below:

In conclusion, Ridder Trader is a regulated broker; however, due to its shortcomings in certain areas, including the number of trading instruments offered, customer service support, lack of information regarding deposit and withdrawal options, and the lack of educational resources, thus WikiFX cannot give it a reasonably high score.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

As the Lunar New Year approaches, renewal is in the air. It is a moment to bid farewell to the old, welcome the new, and reflect while moving forward.

XSpot Wealth has found many negative comments from traders who have allegedly been deceived by the broker. Traders constantly accuse the broker of causing unnecessary withdrawal blocks and forcing them to continue depositing with it. Many user complaints emerged on WikiFX, a leading global forex regulation inquiry app. In this XSpot Wealth review article, we have investigated multiple complaints against the broker. Read on!

Did SEVEN STAR FX make unreasonable verification requests and block your forex trading account later? Did the broker prevent you from accessing fund withdrawals? Were you made to wait for a long time to receive a response from the broker’s customer support official? Have you had to seek legal assistance to recover your stuck funds? Well, these are some claims made by SEVEN STAR FX’s traders. In this SEVEN STAR FX review article, we have looked closely at the company’s operation, the list of complaints, and a take on its regulatory status. Keep reading to know the same.

When traders search for "Is ZarVista Safe or Scam," they want to know if their capital will be safe. Nice features and bonuses do not matter much if you can't trust the broker. This article skips the marketing talk and looks at real evidence about ZarVista's reputation. We want to examine actual user reviews, look into the many ZarVista Complaints, and check the broker's legal status to get a clear picture. The evidence we found shows serious warning signs and a pattern of major user problems, especially about the safety and access to funds. This report gives you the information you need to make a smart decision about this risky broker.