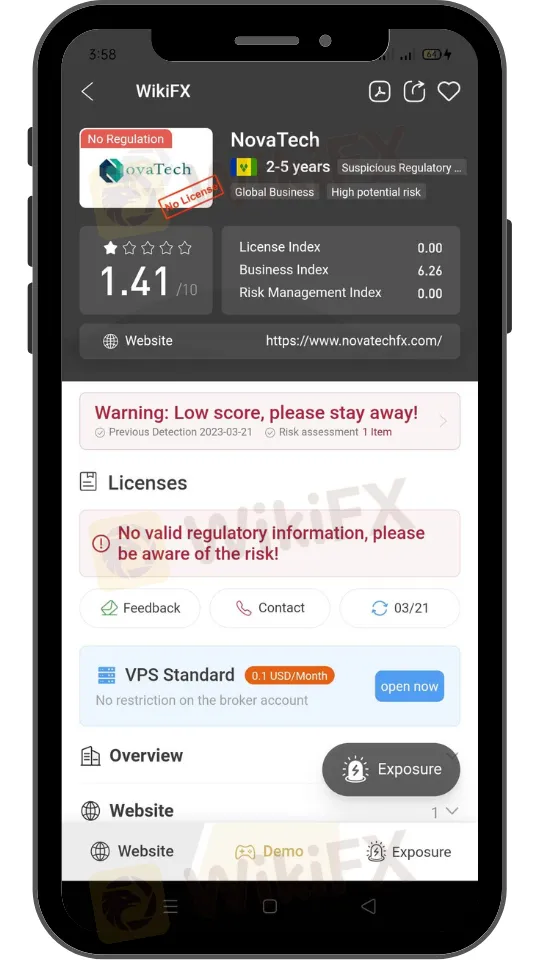

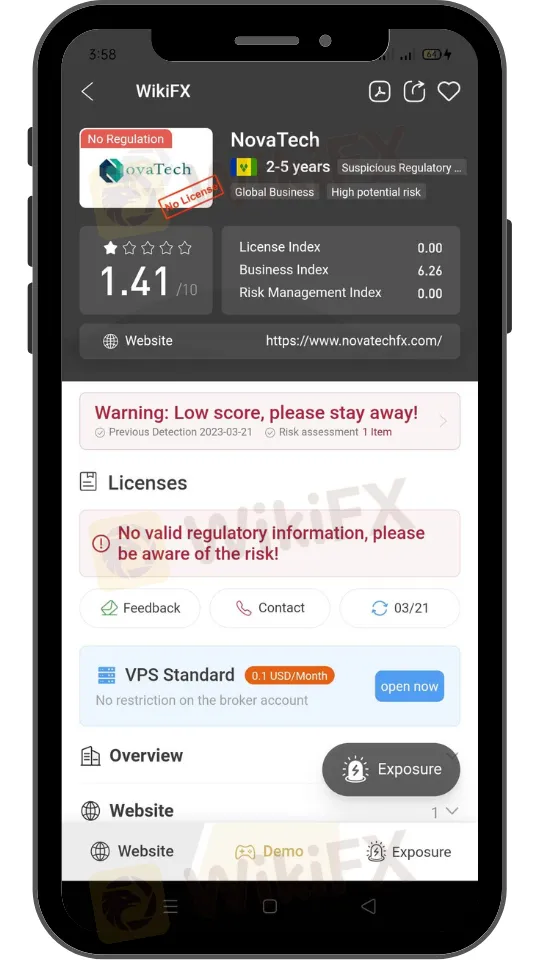

Abstract:The public has been cautioned by the Canadian Securities Administrators (CSA) about Nova Tech Ltd (NovaTech), who claim that the business is not listed with any Canadian securities authority. As a consequence, NovaTech is not permitted to propose to deal in stocks or futures to anyone who resides in Canada

NovaTech may be in violation of provincial and territorial securities and derivatives law, including provisions related to unregulated trading and the illegal distribution of securities. The company appears to offer investment products and trading services through its website.

NovaTech announced a temporary freeze in trading account withdrawals for a period of 60 days on February 5, 2023. The reason for this freeze is unknown.

The Capital Markets Tribunal (Ontario) extended a cease trade order issued by the Ontario Securities Commission on March 2, 2023. The order requires NovaTech to temporarily cease all trading in any securities.

All individuals and businesses trading securities or derivatives, or providing investment advice in relation to securities and derivatives in Canada, including platforms facilitating trading of forex and crypto assets, must comply with applicable securities or derivatives legislation.

Investors should always check the registration of any person or business trying to sell them an investment or provide investment advice. This will help to ensure that they are dealing with legitimate, authorized individuals or businesses.

Canadian Securities Administrators' Role (CSA)

The Canadian Securities Administrators (CSA) is a group of financial officials from each of Canada's 13 provinces and regions. Its main responsibility is to supervise and control Canadian financial markets, ensuring that they are equitable, effective, and open.

The CSA works to safeguard clients by developing and implementing laws that support the securities industry's honesty, openness, and security. It also offers instruction and tools to assist clients in making educated choices.

The CSA's primary responsibility is to create and implement rules and laws for public businesses and stock agents. These laws cover financial filing obligations, transparency standards, and rules regulating market players' behavior. The CSA also checks conformance with these rules and, when appropriate, initiates disciplinary action.

Install the WikiFX App on your smartphone to stay updated on the latest news.

Download link: https://www.wikifx.com/en/download.html?source=fma3