OANDA to Transfer Prop Trading Business to FTMO Platform

After FTMO’s acquisition of OANDA, the transfer of the OANDA Prop Trader service to the FTMO platform begins.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:The Financial Conduct Authority (FCA) maintains a warning list of firms and individuals that it has identified as potentially operating without its authorization and supervision, or that it has concerns about for other reasons. The list is intended to protect consumers and the integrity of the UK financial system by helping them to avoid doing business with these firms and individuals. It is updated regularly, and consumers are advised to check the list before engaging in any financial transactions.

FCA stands for Financial Conduct Authority, which is a regulatory body in the United Kingdom that oversees financial markets and firms to ensure they operate in a way that is fair, transparent, and in the best interests of consumers. The FCA issues warnings to consumers about potential scams, fraudulent activities, and other risks to protect them from financial harm. These warnings can be found on the FCA's website and are often shared through the media and other channels to reach a wide audience.

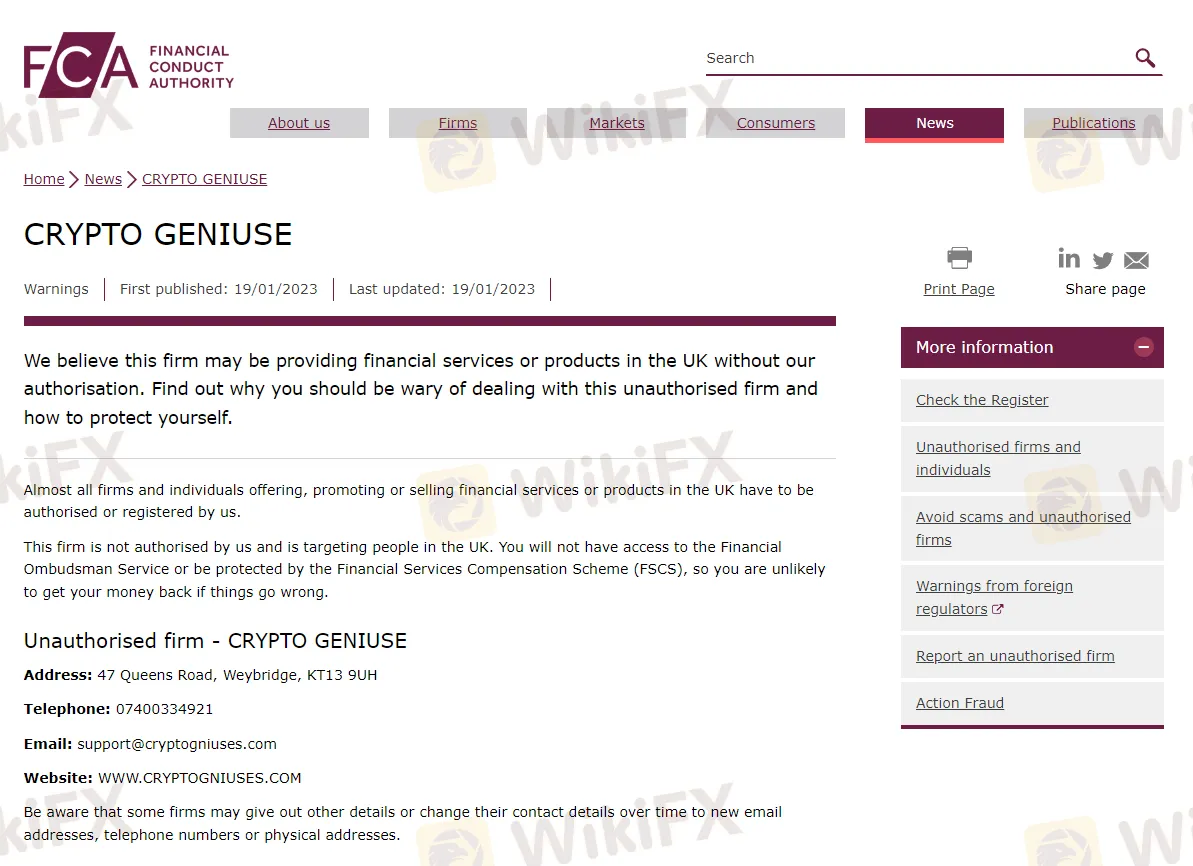

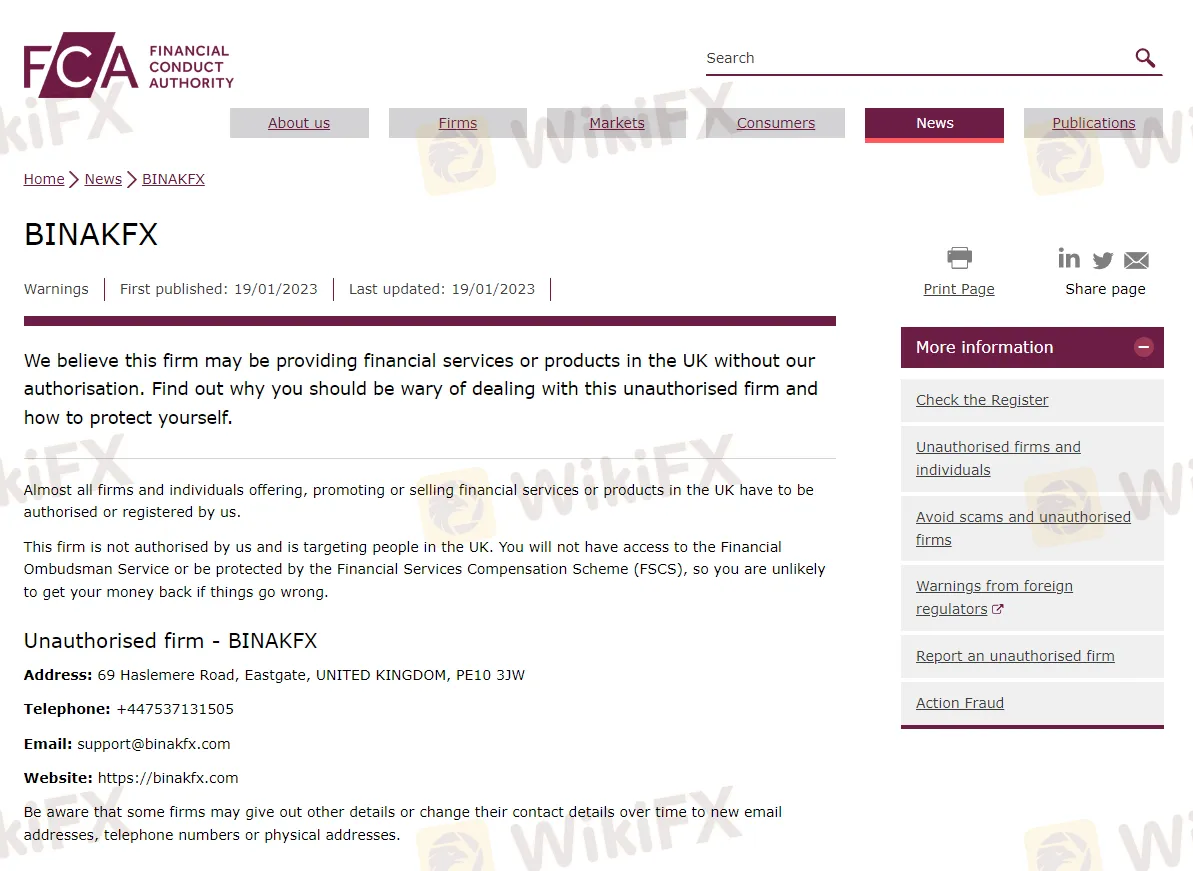

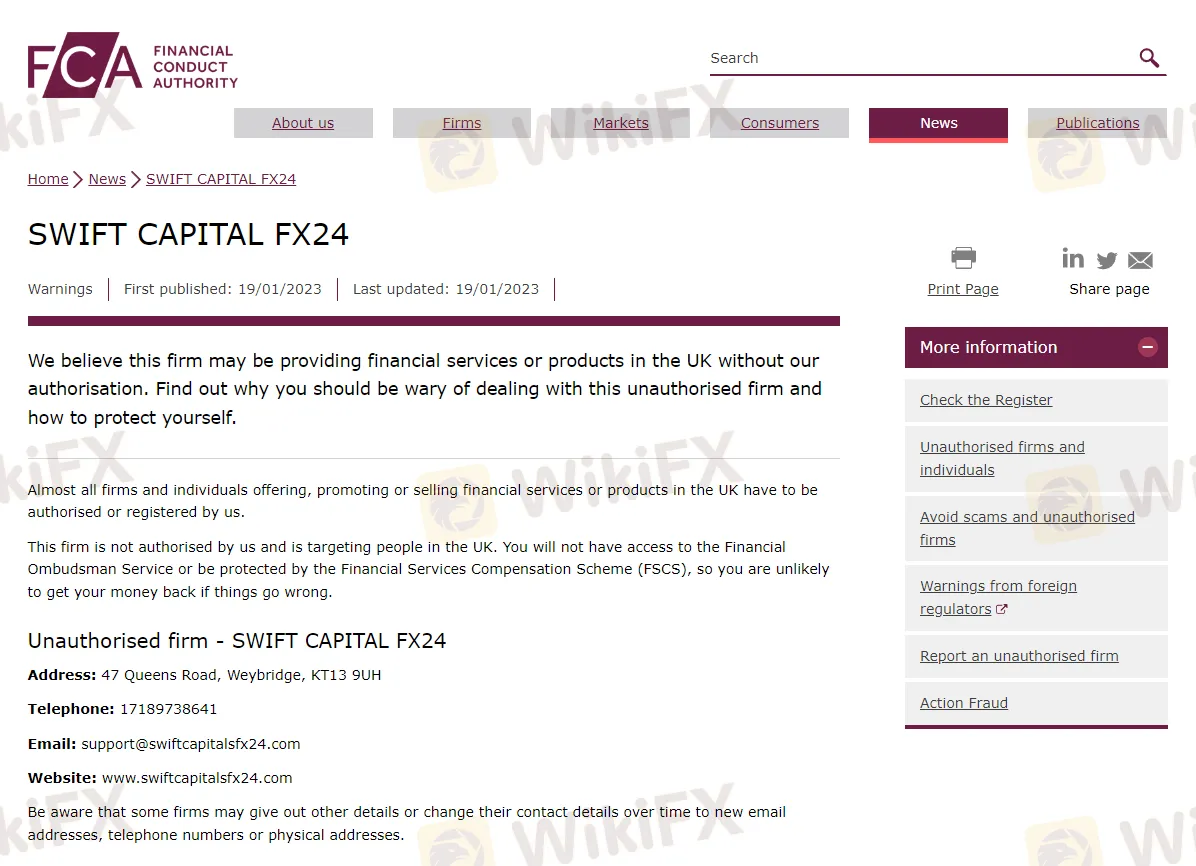

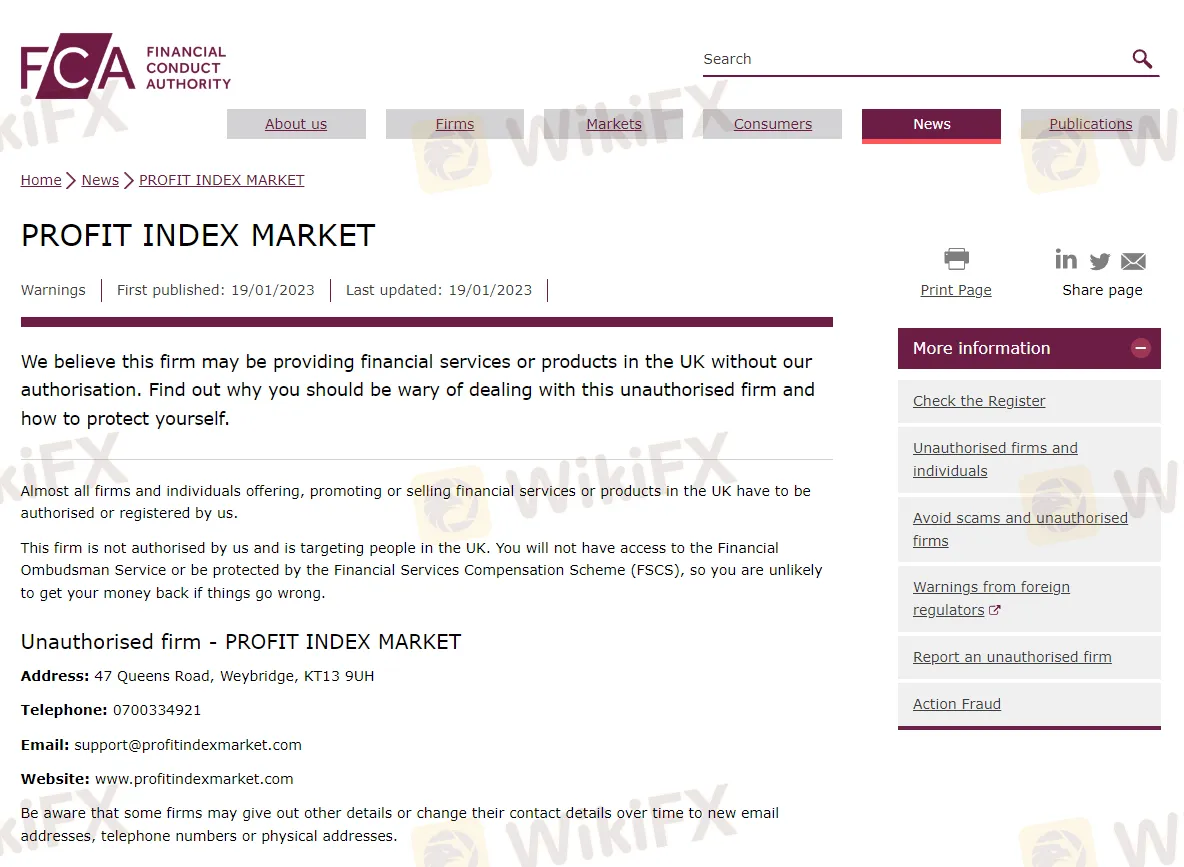

List of unauthorized brokers released on Jan. 19, 2023

CRYPTO GENIUSE

BINAKFX

SWIFT CAPITAL FX24

PROFIT INDEX MARKET

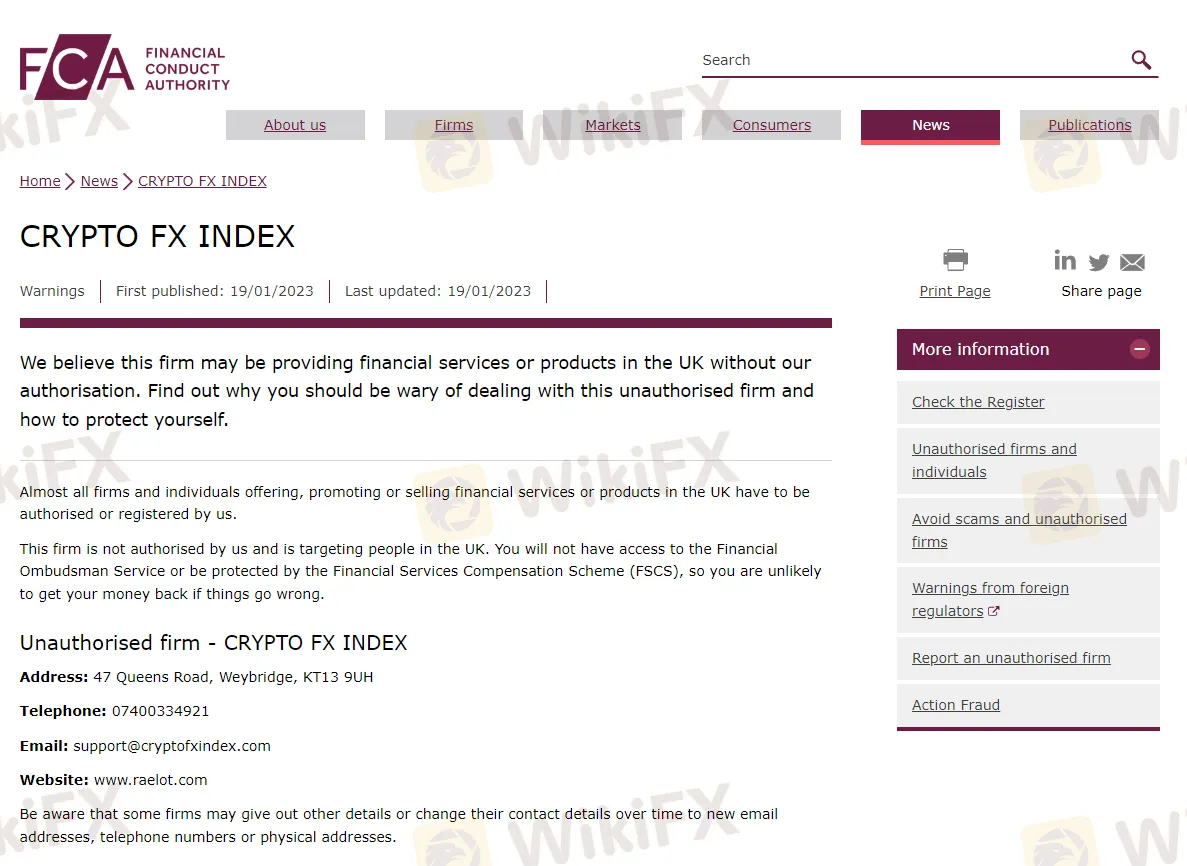

CRYPTO FX INDEX

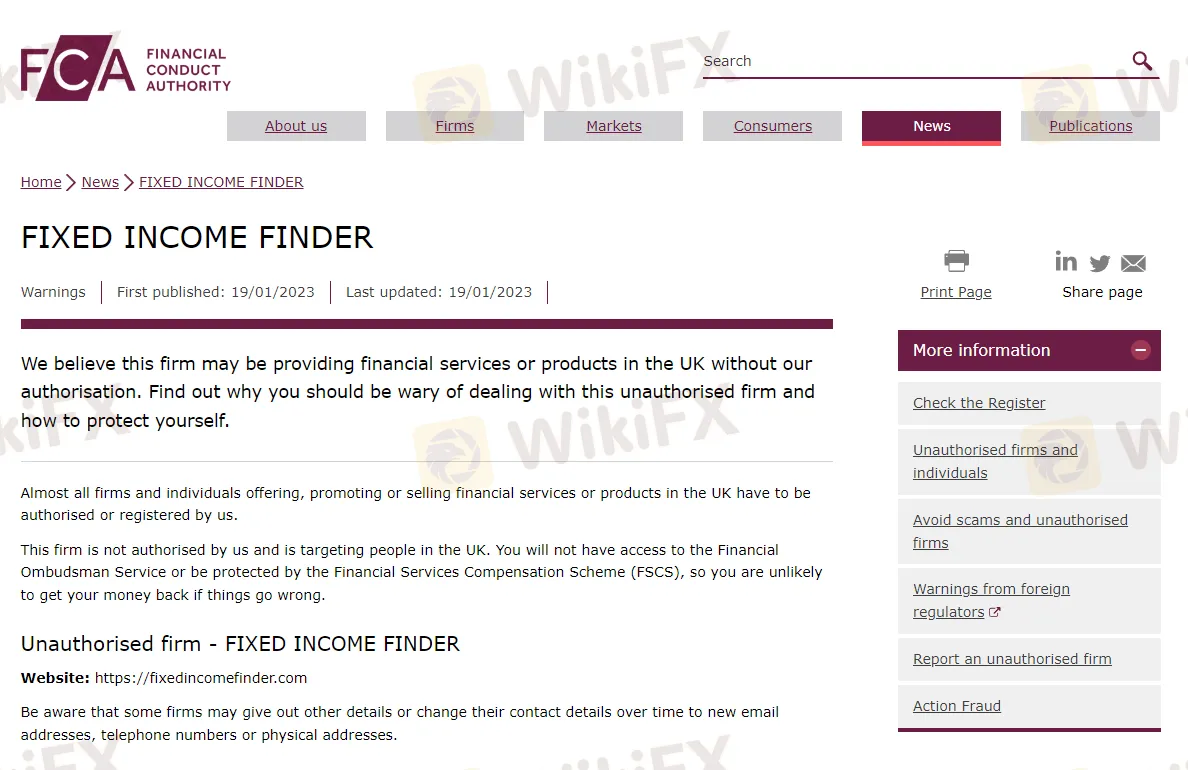

FIXED INCOME FINDER

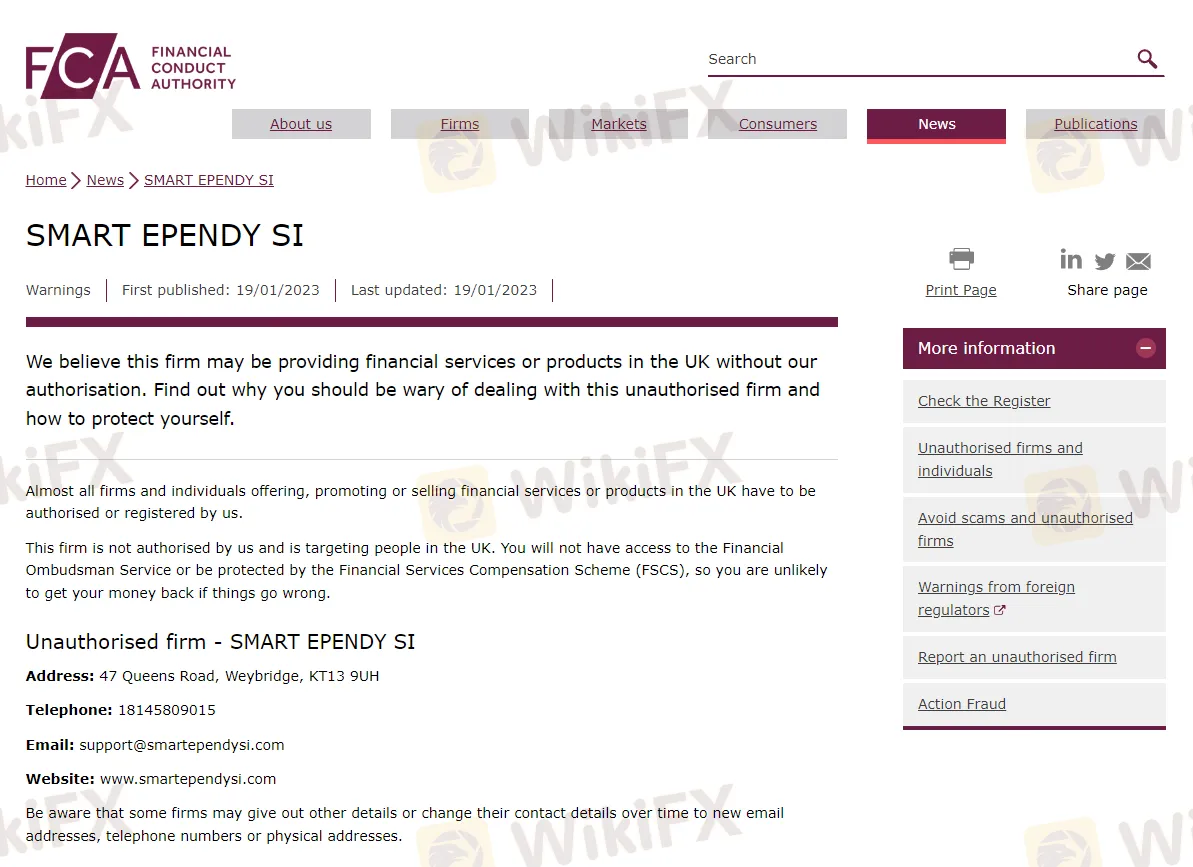

SMART EPENDY SI

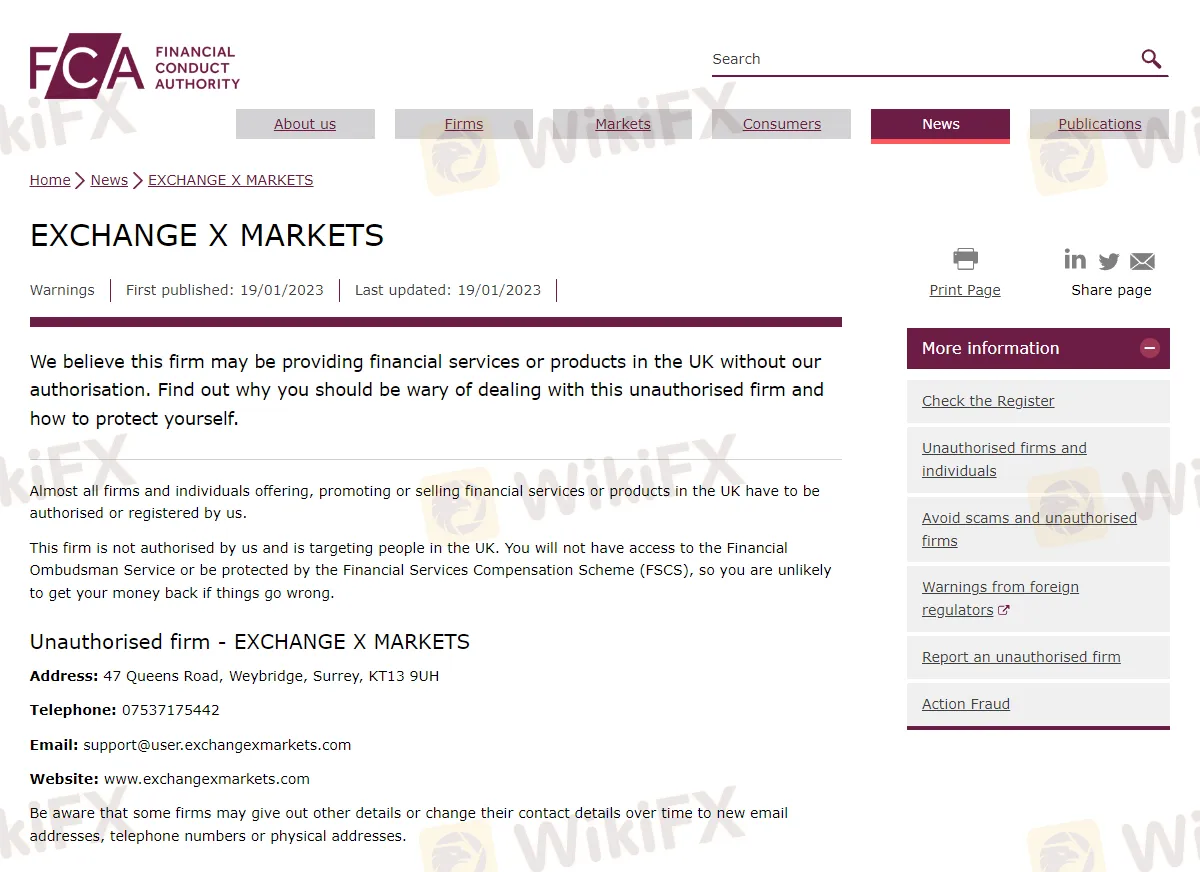

EXCHANGE X MARKETS

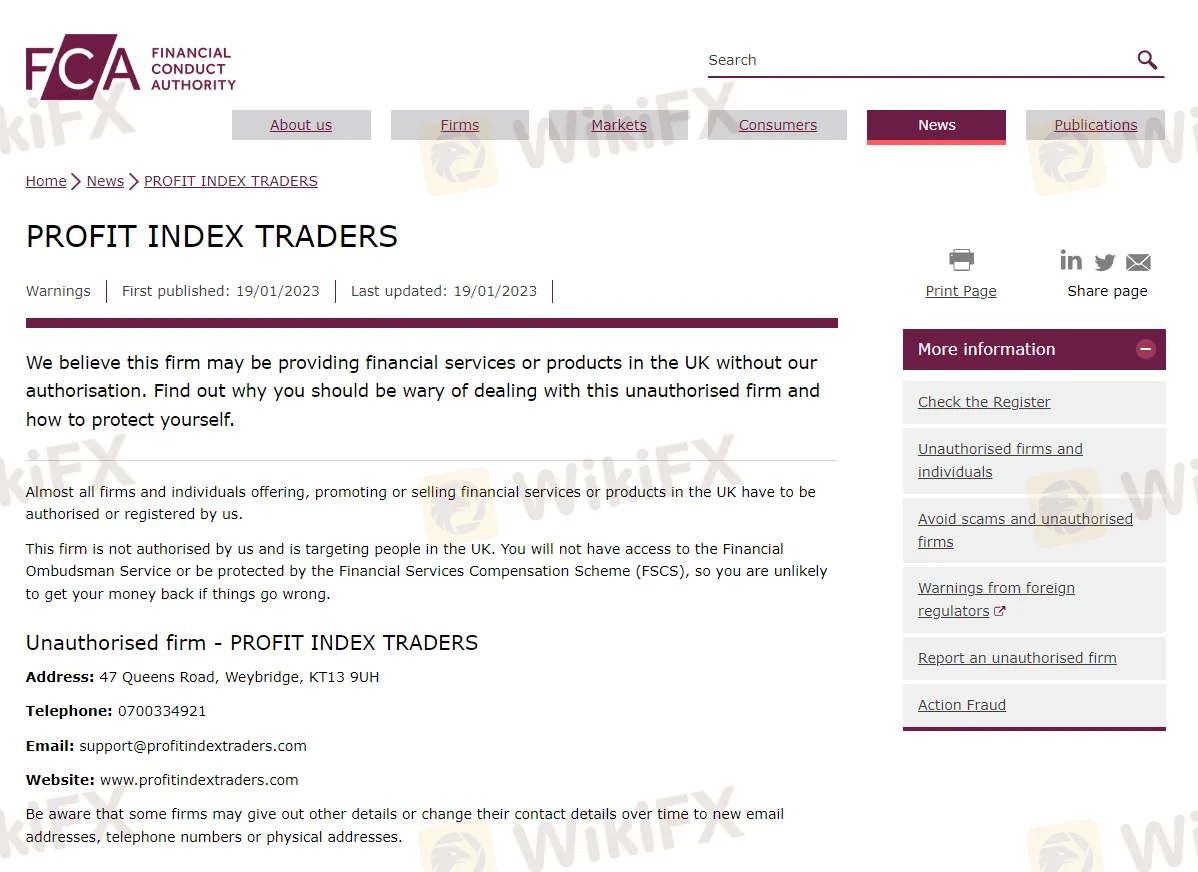

PROFIT INDEX TRADERS

The FCA's warning lists include several categories of firms and individuals that the FCA has identified as posing a potential risk to consumers. These include:

Unauthorised firms: These are firms that are not authorized by the FCA to conduct regulated activities in the UK, but are still offering financial services to consumers. Consumers should be particularly cautious of these firms, as they are not subject to FCA oversight and may not be operating in compliance with regulations.

Fraudulent websites: These are websites that the FCA has identified as being used in fraudulent activities, such as phishing scams or impersonating legitimate firms. Consumers should be careful not to provide personal or financial information to these websites.

Clone firms: These are firms that use the name and details of authorized firms in order to trick consumers into thinking they are dealing with a legitimate company. Consumers should check the FCA's register of authorized firms to confirm the authenticity of any firm they are considering doing business with.

Suspicious investment schemes: These are investment schemes that the FCA has identified as being potentially fraudulent or high-risk. Consumers should be wary of these schemes and should always conduct their own research before investing.

Enforcement actions: These are firms and individuals that the FCA has taken enforcement action against, such as fines or sanctions, for non-compliance with regulations. Consumers should be cautious about doing business with these firms and individuals.

The FCA also issues alerts and press releases to keep consumers informed of any significant risks to consumers and financial markets. It's highly recommended to check the FCA's warning lists and alerts regularly and to be cautious before doing business with any firm or individual that is on the list.

Final word

It is important for consumers to be aware of the FCA warning lists and to check them regularly to ensure they are not doing business with firms or individuals that have been flagged as potentially fraudulent or operating outside of regulations. The FCA's warning lists can be found on their website and include information on unauthorized firms and individuals, as well as firms and individuals that the FCA has taken enforcement action. It's also crucial to note that just because a firm or individual is on the FCA's warning list does not necessarily mean they are operating illegally or fraudulently, but consumers should still exercise caution and do their own research before doing business with them.

Stay tuned for more FCA warning lists of brokers.

You can install the WikiFX App on your mobile phones through the download link below, or from the App Store or Google Play Store.

Download link: https://www.wikifx.com/en/download.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

After FTMO’s acquisition of OANDA, the transfer of the OANDA Prop Trader service to the FTMO platform begins.

1x Trade scam: traders report that profits are being seized and withdrawals are being blocked. Review evidence and secure your funds now.

ACY Securities exposure: dozens of forex scam cases show withheld funds and account blocks; read reports, document losses, and stop deposits today.

FxPro, a United Kingdom-based forex broker, has been facing severe allegations concerning fund withdrawal issues, illegitimate account freezes, trade manipulation, and poor customer support. These allegations have been doing the rounds on several broker review platforms such as WikiFX. In this FXPro review article, we have examined these allegations for you to look at. Keep reading to learn how the broker allegedly worsened traders’ experiences.