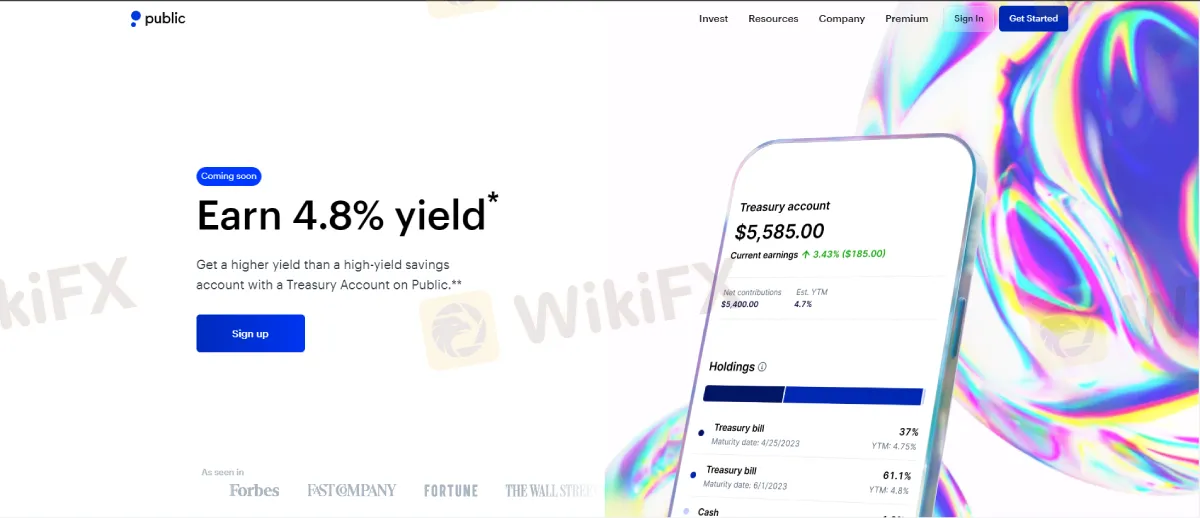

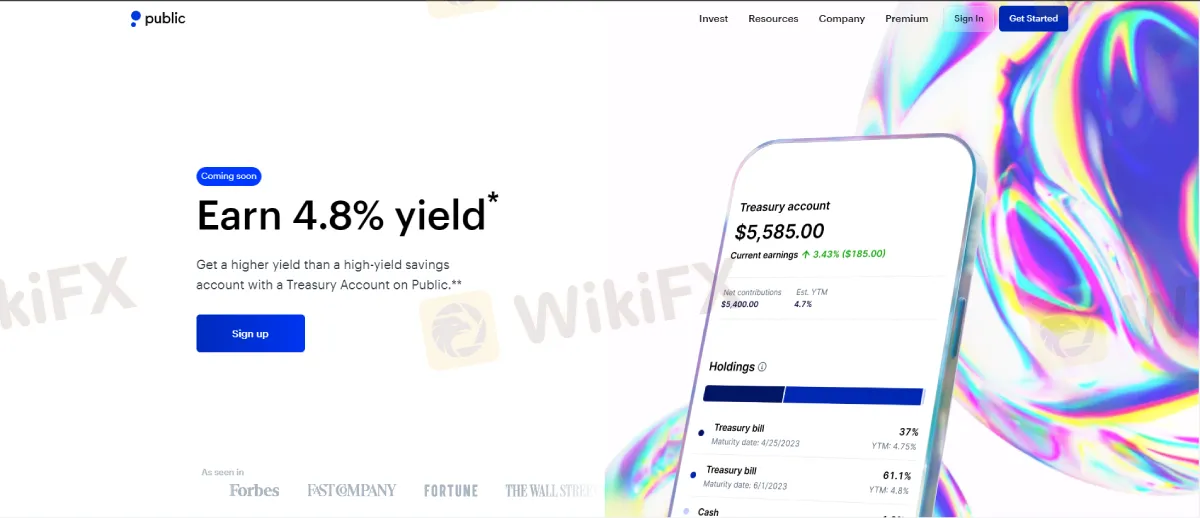

Abstract:Public.com, an online trading platform, intends to provide traders a 4.8% return with a Treasury Account on Public.

Traders who deposit funds in a Treasury Account on Public will get a safe, consistent yield of Treasury bills. The US Treasury issues these short-term securities, which normally provide a greater rate than regular and high-yield savings accounts.

Traders may secure their rate in three easy steps:

Move your funds: By connecting a bank account or making a deposit with your debit card, you may easily transfer your savings to Public.

Make a Treasury Account: After you've transferred your money, you may buy and manage Treasury bills from a single account.

Secure your rate: Treasury bills are fixed-income investments, which implies that their interest rate is established at the moment of purchase.

Jiko Securities, Inc., a licensed broker-dealer and member of FINRA and SIPC provides Treasury bills to the Public. Traders who are Public members may invest in Treasuries for as low as $100 and watch their yield overtime via the app. Furthermore, kids may manage their investments alongside your stocks, ETFs, cryptocurrency, and other assets.

Jiko charges a fixed management fee of 5 basis points per month based on the average daily amount of your Treasury account in exchange for management, trading, and custody of Treasury services. This sum will be debited monthly from your Treasury account. As a referral fee, the public gets a percentage of the management fee.

Download and install the WikiFX App on your mobile phone using the link provided below.

Download link: https://www.wikifx.com/en/download.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.