Abstract:The so-called brokerage STONEBRIDGE is a clone of FCA authorised firm, which was warned by the Financial Conduct Authority in the UK.

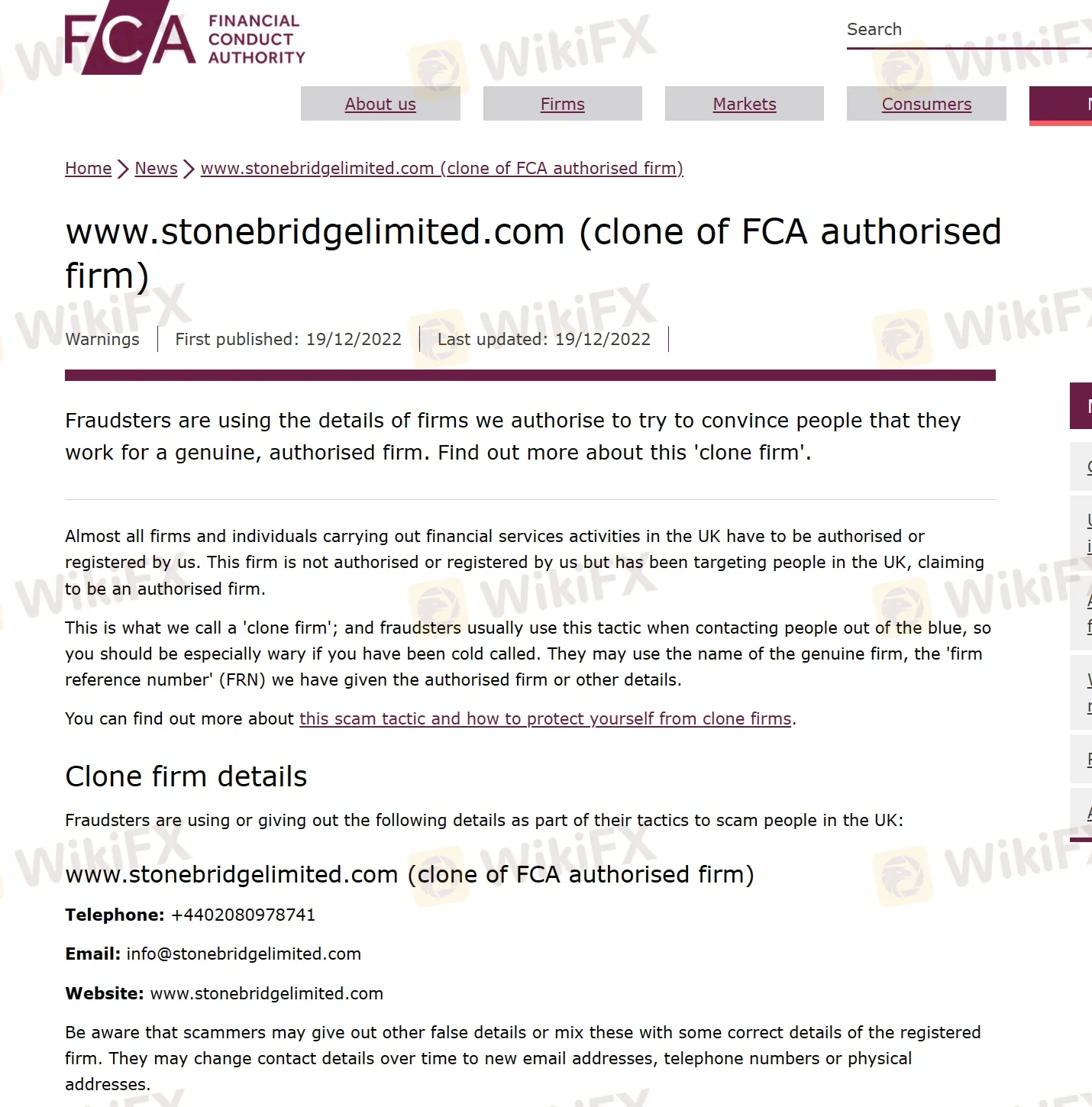

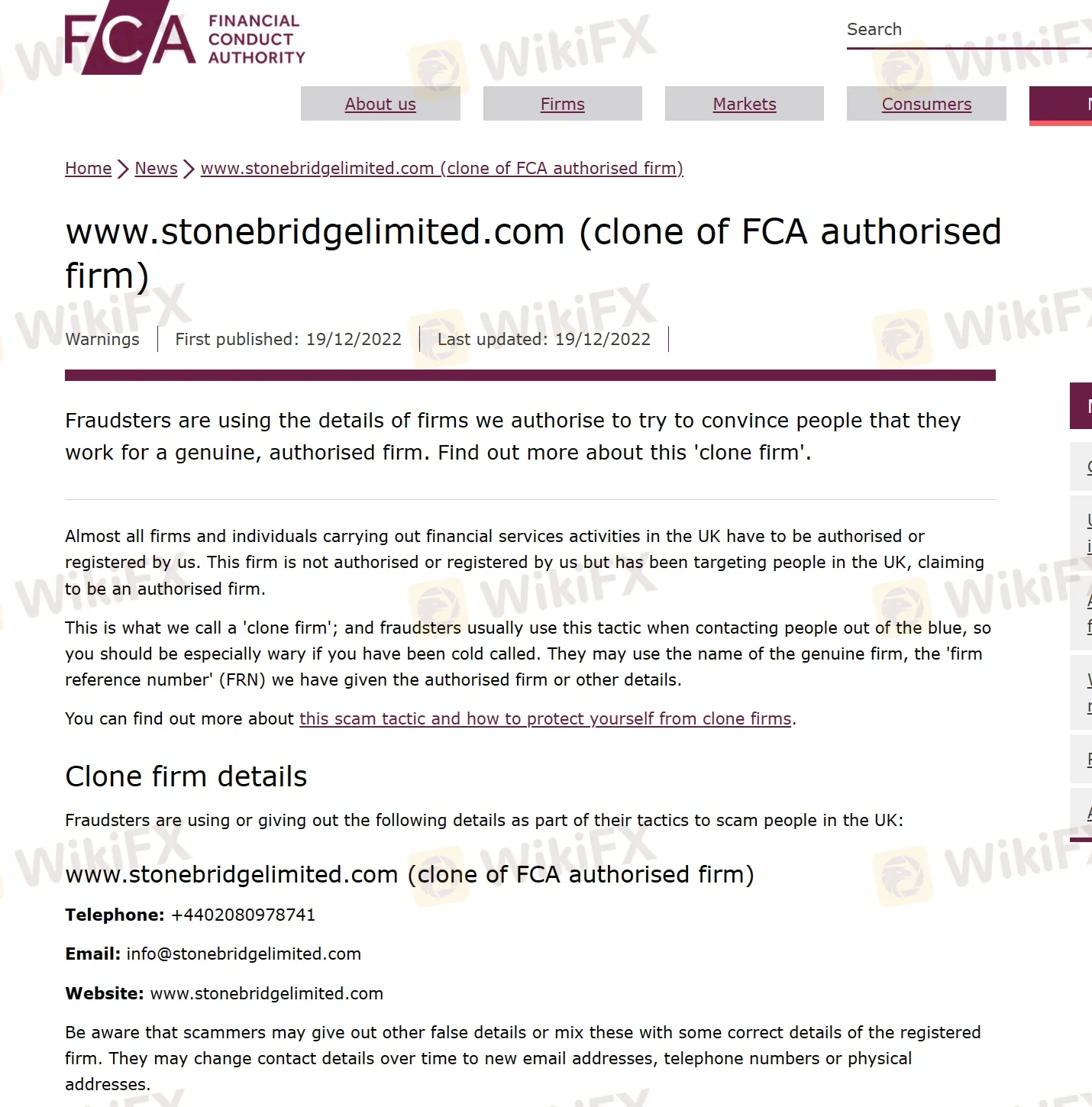

Breaking news! www.stonebridgelimited.com has come to the attention of the Financial Conduct Authority in the UK, which warned on December 19th that STONEBRIDGE has been pretending was authorized by us to offering its financial service. You may see the warning on the screenshot below.

“STONEBRIDGE is totally a clone firm to disguise itself as a licensed company,” The FCA adding that, “Fraudsters are using the details of firms we authorize to try to convince people that they invest with a genuine, authorised firm.”

“All members of the public in the UK should know how to protect themselves. We strongly advise you to only deal with financial firms that are authorised by us, and check the Financial Services (FS) Register to ensure they are. It has information on firms and individuals that are, or have been, regulated by us.”

Such warnings actually effectively exposed it as a clone firm and a scam scheme. Clone firms are dangerous as they impersonate legit companies, which makes it easier for fraudsters to take their investors‘ guards off and scam them out of their money. It’s a simple but very effective strategy, as the number of impostors like STONEBRIDGE is constantly on the rise!

WikiFX also paid a visit to the brokers official website to learn more. So far, its official website is still accessible, proving that Capitextfx is still deceiving investors, their tricks didn't stop with the FCA's warning. According to its website, it's clear that the company is attempting to flout the FCA's warning to prove it was a legitimate company.

STONEBRIDGE claimed to be licensed by the national financial institution, but the warning totally proved that STONEBRIDGE was lying, which was not true, and that the registered number 434419 was attributed to a legist brokerage --STONEBRIDGE Corporate Ltd.

What‘s more, STONEBRIDGE was allowed to set the leverage as high as 1:500 with this broker – no legitimate UK’broker would let you do that. Leverage caps in the EU and England ban brokers from offering leverage higher than 1:30 on forex majors to retail traders. This only goes to show once again that STONEBRIDGE is not a legitimate British broker. Trading with extremely high leverage can be very dangerous and lead to huge losses – which is why you should always be careful with your leverage settings.

Please bear in mind that this is totally a scam uncovered by the authorities. All information on its official website is baseless and untrustworthy. No matter how well the terms and conditions on its website and the trading platform are presented, remember that these are decoys that are trying to lure you in -- once you've deposited your money, the elaborate traps are just beginning.

WikiFX reminds you that forex scam is everywhere, you'd better check the broker's information and user reviews on WikiFX before investing. You can also expose forex scams on WikiFX. WikiFX will do everything in its power to help you and expose scams, warn others not to be scammed.

WikiFX keeps track of developments, providing instant updates on individual traders and helping investors avoid unscrupulous brokers. If you want to know whether a broker is safe or not, be sure to open WikiFXs official website (https://www.WikiFX.com/en) or download the WikiFX APP through this link (https://www.wikifx.com/en/download.html) to evaluate the safety and reliability of this broker!