Abstract:The daily chart for EUR/USD shows that the bullish momentum is building up, although further gains are yet to be confirmed. Technical indicators continue to advance within negative levels, with the Momentum about to cross its midline into positive levels. At the same time, the pair is developing below bearish moving averages, with the 20 SMA currently providing dynamic resistance around 1.0575.

EUR/USD steadies around weekly top following the heavy run-up. Euro bulls take a breather around mid-1.0500s, the weekly high, after positing the heaviest daily jump since early March. Second-tier data may entertain traders, risk catalysts are more important for fresh impulses.

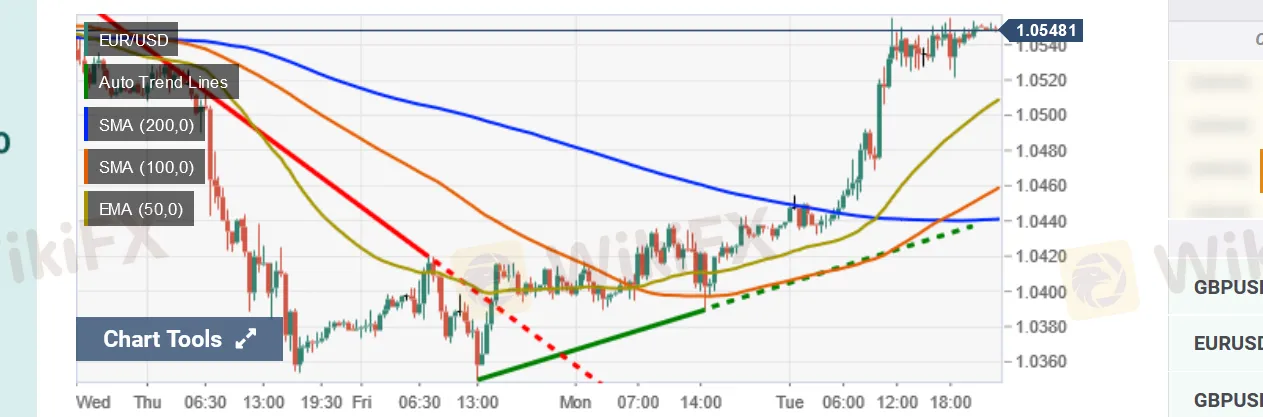

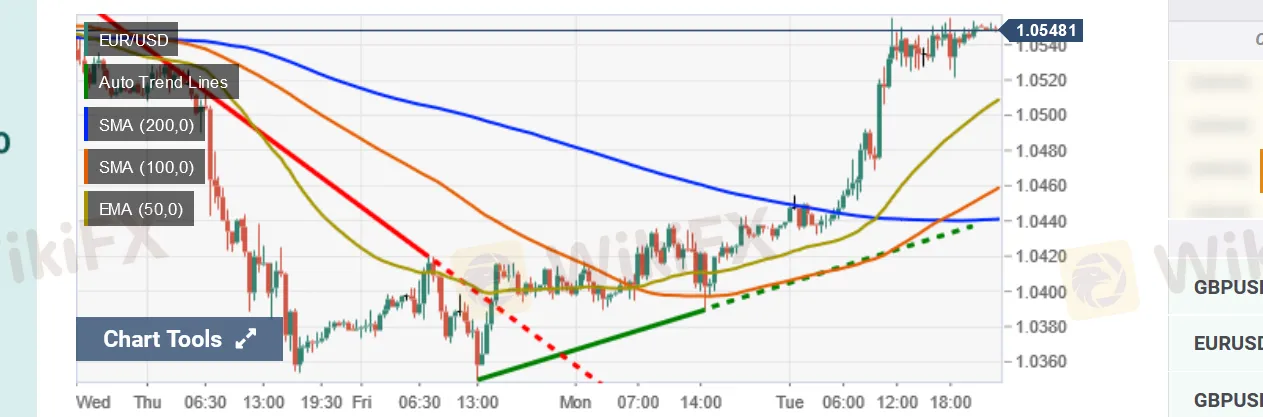

Technical Overview

The daily chart for EUR/USD shows that the bullish momentum is building up, although further gains are yet to be confirmed. Technical indicators continue to advance within negative levels, with the Momentum about to cross its midline into positive levels. At the same time, the pair is developing below bearish moving averages, with the 20 SMA currently providing dynamic resistance around 1.0575.

According to the 4-hour chart, the pair is bullish. It has extended its rally above a now flat 20 SMA while is currently battling to surpass a bearish 100 SMA. Technical indicators, in the meantime, head firmly higher near overbought readings. Further gains could be expected if the pair extends its advance beyond the aforementioned resistance in the 1.0570 region, while the case for bears will return if EUR/USD slides below 1.0470.

Support levels: 1.0510 1.0470 1.0430

Resistance levels: 1.0575 1.0620 1.0660

Fundamental Overview

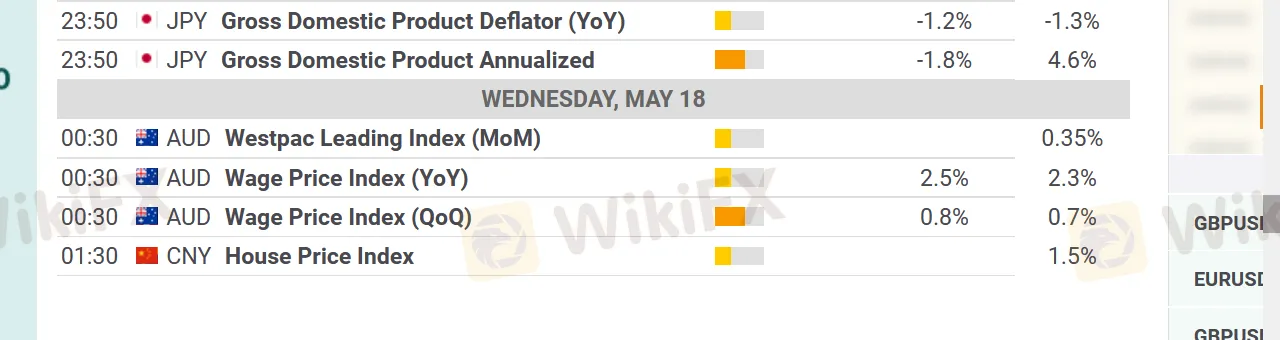

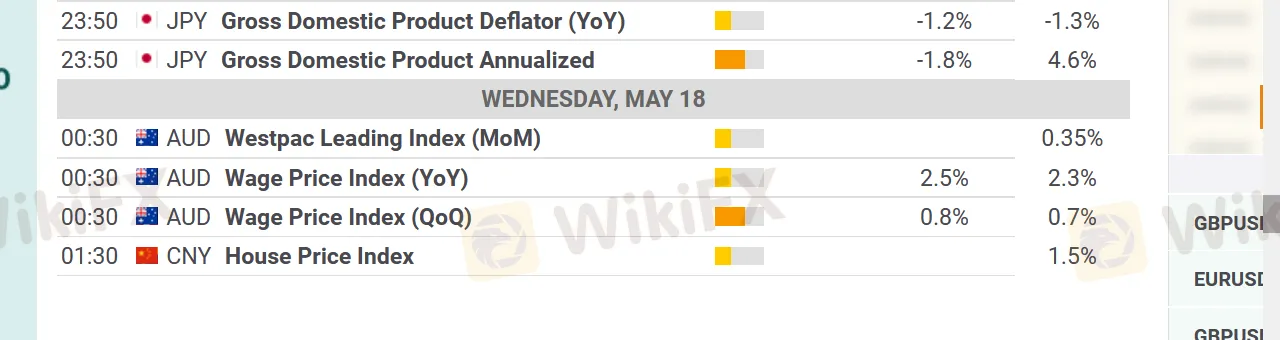

The EUR/USD pair advanced to an intraday high of 1.0555 during the European morning, boosted by comments from European Central Bank Governing Council member Klaas Knot. Speaking on Dutch TV, Knot said that a 50 bps rate hike should not be excluded if data suggest inflation keeps broadening and accumulating. He also added that a 25 bps hike in July would be realistic.

The shared currency was also aided by the positive tone of global stocks, which pointed to a better market mood, despite the underlying issues. Finally, the EU Q1 Gross Domestic Product was upwardly revised to 0.3% QoQ, while the annual comparison was lifted to 5.1% from 5% in the previous estimate.

The pair held on to gains above the 1.0500 ahead of the release of US Retail Sales. According to the official report, sales were up 0.9% in April, better than anticipated. The core reading also beat the markets forecast, as Retail Sales Control Group were up by 1%. The US will later release April Industrial Production and Capacity Utilization.

If you want to know more information about the reliability of certain

brokers, you can open our website (https://www.WikiFX.com/en). Or you

can download the WikiFX APP for free through this link

(https://www.wikifx.com/en/download.html). Running well in both the

Android system and the IOS system, the WikiFX APP offers you the easiest

and most convenient way to seek the brokers you are curious about.