Abstract:The forex market today has over 6.8 trillion dollars in circulation with over 4.5 trillion dollars traded daily. This large amount of capital injected into the Forex Market today which moves the market in both directions come from multiple sources put together. Thus, we have major and minor influencers or movers. This in technical terms is known as the liquidity providers. We shall examine below the major players in the Forex Market today.

By: Chime Amara

The forex market is the only market with the highest traded capital and population. It is the most prevalent of all capital investment in the world today.

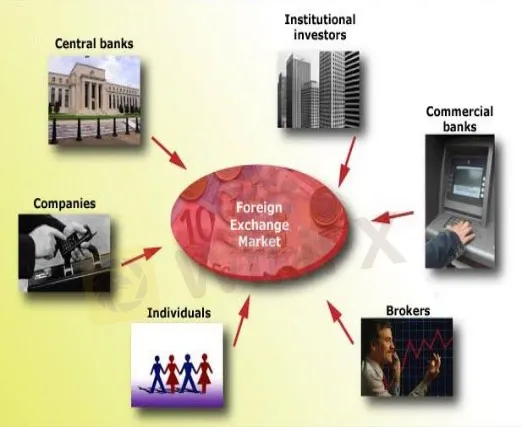

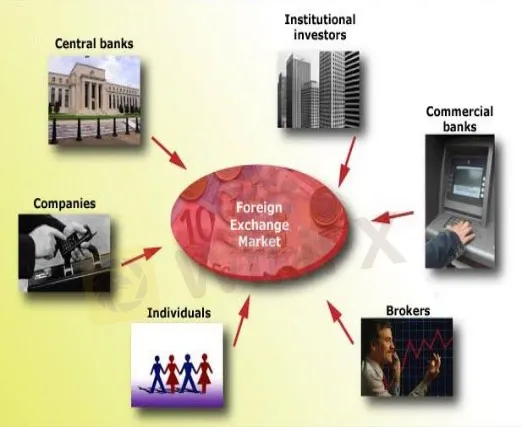

The following could be seen as the major participants in the Forex Market today:

· Large Commercial Banks

· Central Banks

· Hedge Fund Managers

· Brokers

· Small Banks and Institutions

· Retail/Individual Traders

Large Commercial Banks

The commercial banks are the biggest players in the Forex Market. As a matter of fact, it is the commercial banks that control the forex market today. Thus, to be successful in the Forex Market, the first thing every trader must learn is to follow the bank's directions.

Below are a list of the major commercial banks that moves the Forex Market in a special way today and the estimated volume they contribute to the market today:

1. Citi 12.9%

2. JP Morgan 8.8%

3. UBS 8.8 pct Barclays 8.1%

4. Deutsche 7.97.7%

5. BAML 6.4%

6. Barclays 5.7%

7. Goldman Sachs 4.7%

8. HSBC 4.6%

9. XTX Markets 3.9%

10. Morgan Stanley 3.2%

Central Banks

The Central banks influence the Forex Market basically through the policies they make daily. They regulate the currency used in their various country. The central banks are mainly responsible for maintaining inflation in the interest of sustainable economic growth while contributing to the overall stability of the financial system. When central banks deem it necessary they will intervene in financial markets in line with the defined “Monetary Policy Framework”. There are basically two major decisions from the Central banks that moves the market so much today such as: Open market operations and the central bank rate. The implementation of these two policies moves the market to a large extent.

Hedge Fund Managers

Often, portfolio managers, pooled funds and hedge funds make up the second-biggest collection of players in the forex market today next to commercial banks and central banks. Investment managers trade currencies for large accounts such as pension funds, foundations, and endowments.

Brokers

Brokers today are the reason why the retail traders running less than a standard unit account are able to trade the forex market today. This is because the brokers offers the retail traders some leverage that boost their little capital to attain the status of a standard account as to trade the forex market today.

A forex brokerage provides a pathway for the trader to mix with the banking network and purchase a currency pair to hold in an easy manner. Before there were forex brokers, people wishing to trade in foreign currency needed to have a large amount of money and a special relationship with a bank to buy foreign currencies. However, brokers today have bridged this gap and provided avenues for the retail traders to trade with the banks and big institutions.

Institutions

A great number of institutions participate in the Forex Market today through what is known as institutional traders. More than 20% of the total amount traded in the Forex Market today come from the big institutions who partake in the Forex Market as well.

Retail/Individual Traders

The retail/individual traders provide the highest population of the forex market participants today, yet they provide the least capital. Often more than 77% of the individuals traders are able to participate in the Forex Market today due to the leverage provided to them by the forex brokers, otherwise their capital is seen as less than a standard unit account which had been the fundamental unit for trading.