Abstract:Unlock Forex trading success by mastering Major Pairs in Forex. Learn about the most traded, liquid pairs, and their impact on global finance for savvy trading strategies.

Understanding Major Currency Pairs in Forex

The forex market is vast and dynamic. It operates 24 hours a day, five days a week.

At its core are the major currency pairs. These pairs are the most traded and liquid in the market. These include pairs like EUR/USD and USD/JPY. Understanding them is crucial for any forex trader.

These pairs account for the majority of trading volume. Their high liquidity and tight spreads make them attractive.

Economic indicators and geopolitical events influence these pairs. Central bank policies also play a significant role.

The USD is a common component due to its global reserve status. This makes it a key player in major pairs.

Traders use both technical and fundamental analysis to trade these pairs. This helps craft effective trading strategies.

In this guide, we will explore the significance of major currency pairs in Forex.

What are Currency Pairs in Forex?

Currency pairs are the backbone of Forex trading. They represent the exchange rate between two currencies. In a currency pair, the first currency is the base, and the second is the quote.

Forex trading involves buying one currency while selling another. The goal is to profit from changes in exchange rates. Each pair is quoted as a single unit, such as EUR/USD.

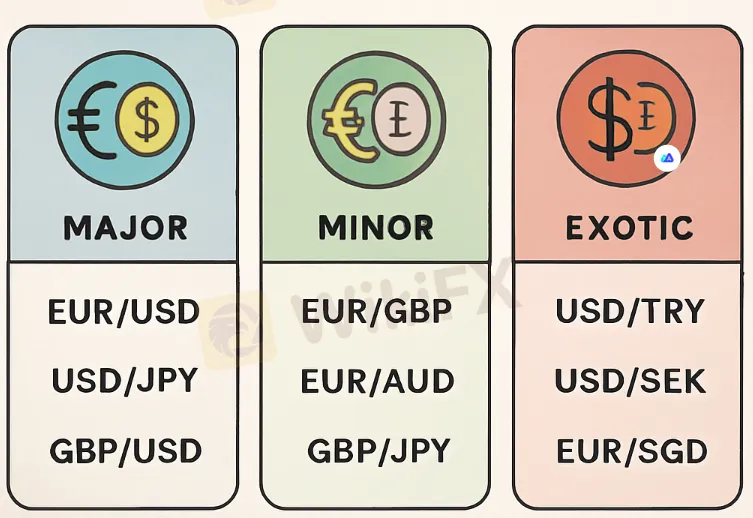

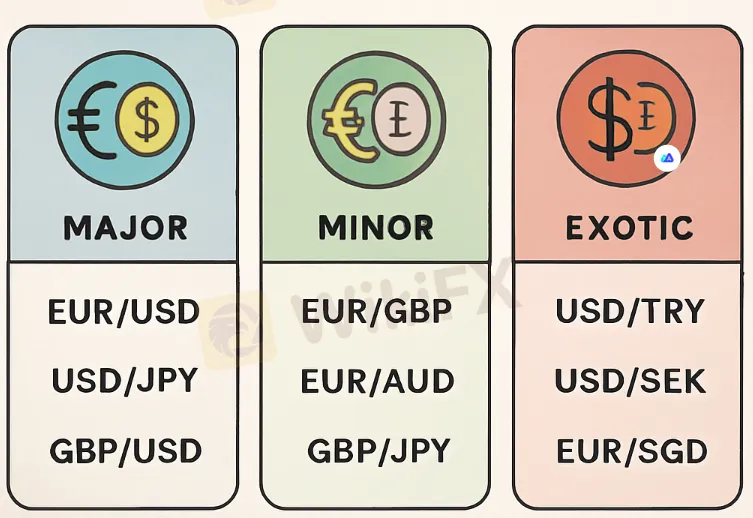

Currency pairs are classified into three main categories: major, minor, and exotic. Major pairs include the most traded currencies, often involving the USD.

Here's a simple breakdown of currency pair components:

- Base currency: The first currency in the pair.

- Quote currency: The second currency in the pair.

- Exchange rate: Indicates how much of the quote currency is needed to buy one unit of the base currency.

Understanding currency pairs is essential for any trader entering the forex market. It provides the foundation for making informed trading decisions. As we delve deeper, grasp the role these pairs play in global currency exchange.

Types of Currency Pairs: Major, Minor, and Exotic

Currency pairs in the forex market are divided into three main categories: major, minor, and exotic. Each has distinct features and trading characteristics. Understanding these types is crucial for traders to develop effective strategies.

Major Pairs

Major pairs include the most traded currencies worldwide. They usually involve the US Dollar (USD) paired with another major currency like the Euro (EUR) or Japanese Yen (JPY). These pairs are known for high liquidity and tight spreads, making them attractive to traders.

Minor Pairs

Minor pairs, sometimes called cross-currency pairs, do not include the USD. Examples include EUR/GBP and AUD/NZD. They are less liquid than major pairs, often resulting in wider spreads. However, they offer opportunities for traders looking beyond the majors.

Exotic Pairs

Exotic pairs consist of a major currency paired with a currency from a smaller or emerging market. These pairs, such as USD/TRY, are less liquid and more volatile. They can offer higher returns but come with greater risk.

Recognizing the differences among these pairs helps traders choose the best options for their trading style. Each type offers unique challenges and opportunities, vital for developing diverse trading strategies.

What are Major Pairs in Forex?

Major forex pairs are the backbone of the market. They consist of the most traded and liquid currency pairs globally. These pairs generally include the US Dollar, reflecting its dominance in global finance.

Traders favor major pairs due to their high liquidity and minimal spreads. This makes entering and exiting positions easier. They are considered stable compared to minors and exotics.

The importance of major pairs extends beyond trading. They serve as benchmarks for many market analyses and strategies. Their behaviors often influence other pairs.

Examples of Major Pairs:

- EUR/USD (Euro/US Dollar)

- USD/JPY (US Dollar/Japanese Yen)

- GBP/USD (British Pound/US Dollar)

- USD/CHF (US Dollar/Swiss Franc)

Understanding major currency pairs is crucial for anyone engaged in forex trading. These pairs offer predictability and opportunities for successful trades.

The List of Major Currency Pairs

Major currency pairs dominate forex trading as they encompass leading currencies globally and offer unmatched liquidity. The popularity is due to their stability and tight spreads.

The major pairs include:

- EUR/USD

- USD/JPY

- GBP/USD

- USD/CHF

- AUD/USD

- USD/CAD

- NZD/USD

These pairs account for the majority of Forex trading volume. The USD is a common element due to its reserve currency status.

They provide insights into the economic health of participating countries. Their predictability makes them attractive to new traders and seasoned professionals alike.

Forex platforms often highlight major pairs for analysis and trading. They are integral to formulating various trading strategies. Understanding these pairs can significantly boost trading success.

EUR/USD (Euro/US Dollar)

The EUR/USD pair is the most traded in the Forex market. It represents the Eurozone and US economy, offering vast liquidity.

This pair is favored for its low cost and high activity. Economic data from both regions heavily influences its movement.

USD/JPY (US Dollar/Japanese Yen)

USD/JPY is popular among traders due to its stability. It represents the US and Japanese economic dynamics.

Significant movements often occur during market volatility. This pair reacts to US interest rates and geopolitical events.

GBP/USD (British Pound/US Dollar)

The GBP/USD pair, also known as Cable, is notable for its volatility. Traders often use it for short-term opportunities.

Economic news from the UK and the US impacts its fluctuations. The pair offers potential for swift gains.

USD/CHF (US Dollar/Swiss Franc)

USD/CHF is considered a safe-haven pair. It benefits from Switzerland's stable and secure economy.

This pair often reacts to global market stress. Traders use it to hedge against currency risks.

AUD/USD (Australian Dollar/US Dollar)

AUD/USD reflects trade relations between Australia and the US. This pair is sensitive to commodity prices, especially gold.

Economic reports from Australia and the US guide its movements. This pair can provide steady trading opportunities.

USD/CAD (US Dollar/Canadian Dollar)

USD/CAD, known as the Loonie, links the US and Canadian economies. It is highly impacted by crude oil prices.

Currency traders watch for economic data and oil price shifts. The pair provides avenues for calculated trades.

NZD/USD (New Zealand Dollar/US Dollar)

The NZD/USD pair highlights New Zealand's relationship with the US. Agricultural exports significantly influence its price changes.

Interest rates and market sentiment play key roles. It is popular for its predictability and stability.

Why are Major Pairs the Most Traded Forex Currency Pairs?

Major pairs dominate the forex market due to their high liquidity. This makes transactions swift and cost-effective. Traders prefer these pairs for tighter spreads and reduced costs.

The global economic significance of these currencies adds to their appeal. Countries like the US, Japan, and the Eurozone have substantial impacts on global trade. Consequently, their currencies form the backbone of forex trading.

These pairs are easily accessible on trading platforms. Their predictability aids in strategy formulation and market analysis. Their involvement in international trade further fuels their popularity.

Key reasons major pairs are so heavily traded include:

- High liquidity

- Tight spreads

- Economic impact

- Accessibility

In summary, major currency pairs are foundational to forex. Their attributes make them indispensable to traders worldwide. Understanding them can guide your trading journey to success.

Key Characteristics of Major Forex Pairs

Major forex pairs exhibit distinct traits that attract traders globally. Their foremost trait is high liquidity, enabling swift transactions and stable pricing.

Tight spreads are another key feature. This reduces the cost of trading and enhances profitability. Traders appreciate these cost-efficient conditions when engaging in forex trading.

These pairs exhibit lower volatility compared to exotic pairs. This stability allows traders to predict movements and apply technical analysis effectively.

The inclusion of the USD in these pairs offers reliability due to its status as a global reserve currency. Trust in the US economy further solidifies the dollar's role.

Key features of major pairs include:

- High liquidity

- Tight spreads

- Lower volatility

- USD involvement

Overall, these characteristics ensure that major forex pairs remain a focus. Their benefits support informed trading decisions and strategic market participation.

Factors Influencing Major Currency Pairs

Multiple factors significantly impact the movement of major currency pairs in forex markets. Economic indicators are primary drivers. Reports like GDP, employment data, and inflation numbers can swiftly influence currency values.

Geopolitical events also play a crucial role. Political stability or turmoil can lead to rapid shifts in currency strengths. Traders must stay glued to global news updates.

Central bank policies are equally pivotal. Interest rate changes or monetary interventions by institutions like the Federal Reserve or the European Central Bank can alter pair valuations.

To summarize, key influencers include:

- Economic indicators

- Geopolitical events

- Central bank policies

Understanding these factors helps traders strategize and anticipate market moves. Being informed offers a competitive edge in forex trading, especially with major pairs. This knowledge is vital for effective market participation.

Major Pairs vs. Minor and Exotic Pairs

Major, minor, and exotic pairs each have distinct characteristics that traders must understand. Major pairs, like EUR/USD, are popular for their high liquidity and stable spreads. They are preferred by many due to their predictable market behavior.

Minor pairs, however, involve non-US dollar currencies. They include pairings such as EUR/GBP and AUD/JPY. These pairs generally show less liquidity compared to majors but more than exotics.

Exotic pairs often consist of a major currency and a currency from a smaller or emerging market. They include combinations like USD/TRY (US Dollar/Turkish Lira). They tend to have higher volatility and wider spreads.

To summarize, currency pairs are categorized into:

- Major pairs

- Minor pairs

- Exotic pairs

Understanding these differences helps choose the best pairs to trade based on liquidity, spread, and volatility. Accurate knowledge of each type is crucial for effective forex trading.

How to Trade Major Currency Pairs: Strategies and Tips

Trading major currency pairs can be highly rewarding due to their liquidity. Effective strategies often leverage this characteristic for better trade execution. It is essential to adopt suitable strategies for maximizing potential profits.

Technical analysis is a popular tool among forex traders. Analyzing charts and patterns helps forecast price movements in major pairs. Using indicators can reveal trends that aid in decision-making.

Fundamental analysis examines economic indicators and geopolitical events. Such analysis is crucial because these factors heavily influence major currency pairs. Keeping up with news releases is a part of this strategy.

A successful trader often incorporates a mix of different strategies. Key strategies may include:

- Technical analysis

- Fundamental analysis

- Risk management techniques

Adopting strict risk management practices is essential. Use stop-loss orders to limit potential losses. Consistency and discipline are vital in managing trades effectively.

Finally, continuous learning is crucial in forex trading. Staying informed of market changes allows you to adapt to evolving conditions. This adaptability can enhance trading performance in a dynamic forex environment.

Best Times to Trade Major Forex Pairs

Trading major currency pairs can be more profitable during peak times. Liquidity and volatility peak during the overlap of major trading sessions. This overlap offers traders the best conditions to execute trades.

Understanding global market hours is key to effective trading. Certain periods see higher activity due to overlapping markets. For example, the London and New York sessions overlap offers prime opportunities.

Here are optimal times to trade major pairs:

- London and New York session overlap

- Asian session

- European session

Trading during these times gives access to higher market activity. Increased volatility and liquidity can lead to faster execution and potentially larger gains. Recognizing these periods helps traders make informed decisions.

Risks and Challenges When Trading Major Pairs

Trading major currency pairs carries several risks and challenges. Even with high liquidity, fluctuations can be unpredictable. Volatile markets can swiftly lead to unexpected losses.

Understanding market dynamics is crucial. Economic news can impact major pairs instantly. Traders must stay updated on geopolitical events and economic indicators.

Here's a list of common challenges:

- Rapid market changes

- Economic and political events

- High volatility

Mitigating these risks requires diligence and a solid strategy. Proper risk management and staying informed are key to success in Forex trading.

Conclusion: Why Focus on Major Currency Pairs in Forex Trading?

Focusing on major currency pairs offers stability and predictability in the forex market. These pairs provide the ideal blend of liquidity and tight spreads, making them appealing to traders.

Understanding major pairs is essential for crafting effective trading strategies. Their role in global trade and finance underscores their importance. For traders, they provide opportunities to capitalize on market movements efficiently.