مقدمة عن الشركة

| Jarden ملخص المراجعة | |

| تأسست | 1961 |

| البلد/المنطقة المسجلة | نيوزيلندا |

| التنظيم | منظم بواسطة ASIC (أستراليا) |

| أدوات السوق | الأسهم، الفوركس، السلع، العقود الآجلة، الخيارات |

| حساب تجريبي | ❌ |

| الرافعة المالية | / |

| الانتشار | / |

| منصة التداول | Ranos، Commtrade، Market Trader |

| الحد الأدنى للإيداع | / |

| دعم العملاء | نموذج الاتصال |

| هاتف: +61 2 8077 1300 | |

| البريد الإلكتروني: info@afca.org.au | |

| العنوان: الطابق 54، برج حاكم فيليب 1 فارير بلايس سيدني نيو ساوث ويلز 2000 | |

معلومات Jarden

Jarden هو وسيط مقره في نيوزيلندا تأسس في عام 1961، وهو مرخص من قبل ASIC. يقدم مجموعة متنوعة من أدوات السوق، على سبيل المثال: الأسهم، الفوركس، السلع، العقود الآجلة، والخيارات.

الإيجابيات والسلبيات

| الإيجابيات | السلبيات |

| منظم بواسطة ASIC | معلومات تداول محدودة |

| أصول تداول متنوعة | لا يدعم MT4 و MT5 |

| قنوات اتصال متعددة | لا توجد حسابات تجريبية |

| تم تأكيد وجود مكتب فيزيائي | |

| وقت تشغيل طويل |

هل Jarden شرعي؟

Jarden مرخص بواسطة هيئة الأوراق المالية والاستثمار الأسترالية (ASIC)، تحت JARDEN AUSTRALIA PTY LTD، برقم ترخيص 000485351.

| الحالة التنظيمية | منظم بواسطة | المؤسسة المرخصة | نوع الترخيص | رقم الترخيص |

| منظم | هيئة الأوراق المالية والاستثمار الأسترالية (ASIC) | JARDEN AUSTRاليا PTY LTD | صانع سوق (MM) | 000485351 |

مسح ميداني لـ WikiFX

قام فريق مسح ميداني من WikiFX بزيارة عنوان Jarden في أستراليا، ووجدنا مكتبه على الفور، مما يعني أن الشركة تعمل بمكتب فعلي.

ما الذي يمكنني التداول به على Jarden؟

| أدوات التداول | مدعوم |

| الأسهم | ✔ |

| الفوركس | ✔ |

| السلع | ✔ |

| العقود الآجلة | ✔ |

| الخيارات | ✔ |

| المؤشرات | ❌ |

| الأسهم | ❌ |

| العملات الرقمية | ❌ |

| السندات | ❌ |

| صناديق الاستثمار المتداولة | ❌ |

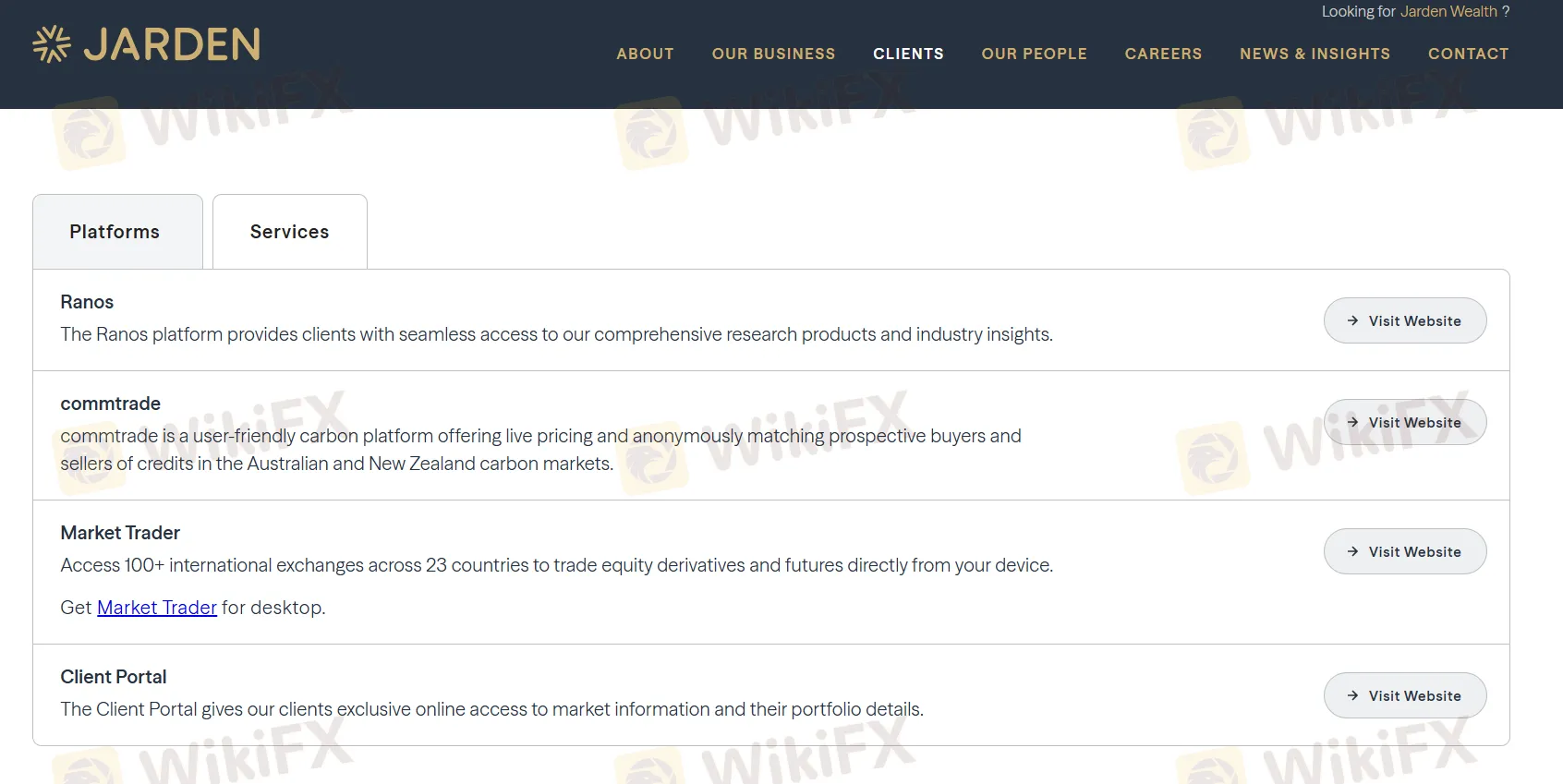

منصة التداول

| منصة التداول | مدعوم | الأجهزة المتاحة | مناسبة لـ |

| Ranos | ✔ | ويب (قائم على المتصفح) | / |

| Commtrade | ✔ | ويب (قائم على المتصفح) | / |

| Market Trader | ✔ | ويندوز | / |

| MT4 | ❌ | / | المبتدئين |

| MT5 | ❌ | / | المتداولين المتمرسين |